We will receive a commission if you make a purchase through our affiliate link at no extra cost to you. Please read our disclosure policy for more information.

We all want passive income so that we can stop working!

Or maybe you don’t want to stop working. Perhaps you want to learn how to generate passive income while working a full-time job. That’s teaching yourself how to make money without a job!

Ah, yes.

Generating passive income and making money while you sleep is what everyone dreams of.

Just imagine how your life would feel with multiple streams of passive income!

Sounds pretty impossible and far-fetched, doesn’t it?

I hear ya…

For many years, I was constantly daydreaming about the day I could quit my job and live off passive income.

UPDATE: This post was originally written by me many years ago when I was trying to figure out how to make enough money to quit my job. I even mentioned how much I hate working but need money on this blog prior to earning a full time blogger salary of six figures per year.

Now, I’m going to talk about the many ways to earn passive income from home so you can finally learn how to make enough money to quit your job too!

Passive Income Jobs From Home

I’ve been scouring the internet for information on how I could passively make money online so I could quit the job I dislike.

I’ve even tried taking surveys online with free legitimate resources like Swagbucks and Survey Junkie for some extra cash. Though I really like earning an extra $20 to $50 per month by taking surveys, which is great for extra spending on things like food, groceries, and gifts, it’s not enough to build my savings to invest in real assets that could help me reach financial independence.

So, when I first started my blog, I wrote a motivational post, This Quote By Warren Buffett Will Inspire You To Become Rich. It was one of my first heartfelt posts that describes how I (and most of you) feel having to work for someone every single day…

For the rest of your life…

Eek!

I’m sure most of you can relate, right?

I honestly couldn’t bear the thought of clocking in and out of a job every single day. That’s when I started looking for passive income ideas to make extra money. My goal is to earn enough so that I can quit my job one day.

If you don’t find a way to make money while you sleep, you will work until you die — Warren Buffett

How to make passive income

After following Warren Buffet’s wisdom and reading inspirational books like Rich Dad Poor Dad by Robert T. Kiyosaki, I was even more motivated to pursue the idea of passive income and quit my job.

My family was living on a low-income minimum wage and we were always broke with no money. But I didn’t care how poor I was at that time. I still wanted to know how to get rich in my 20s and how to become a millionaire by 30.

They are right when they say we don’t have a lot of time within a day to work for money.

Instead, we need money to work for us so that we can free up our time to do things that actually matter to us. That includes spending more time with our family and friends. Because let’s face it, life is short…

You can relate, right?

After working for 8 years, I am starting to see that there’s more to life than just a job in a toxic environment filled with politics. For many years, I’ve been working at building a diversified income stream so that I could say bye to the 9-5 grind.

I want to be able to help you too!

It won’t be a walk in the park, but with hard work and effort, it’s very possible for you to create passive income streams that will allow you to free up your time and eventually achieve financial freedom. You just need to choose something that works for you.

Examples of passive income

From my extensive research, I am SUPER excited to put together this list of passive income ideas for you.

Today, I’m sharing the best passive income ideas that you need to try!

One of my favorites is #2 because almost anyone can start at a very low cost with NO experience required! 🙂

1. Get out of debt first

Here’s the first and best advice when you’re getting ready to make money while you sleep.

Do you still owe interest on credit cards and student loans? The quicker you pay back those pesky loans, the sooner you can start generating passive income.

Think about it.

Every month, you’re making $100, 300, $500, etc. debt repayments to your lenders who are making a killing off of you. Wouldn’t it be nice to allocate that same $100, $300, $500, etc. into investments that PAY YOU passive income?

Getting out of debt will free up a chunk of cash for you to put towards investments that generate passive income and/or growth returns. You can learn how to get out of debt fast here.

2. Start a blog that makes money!

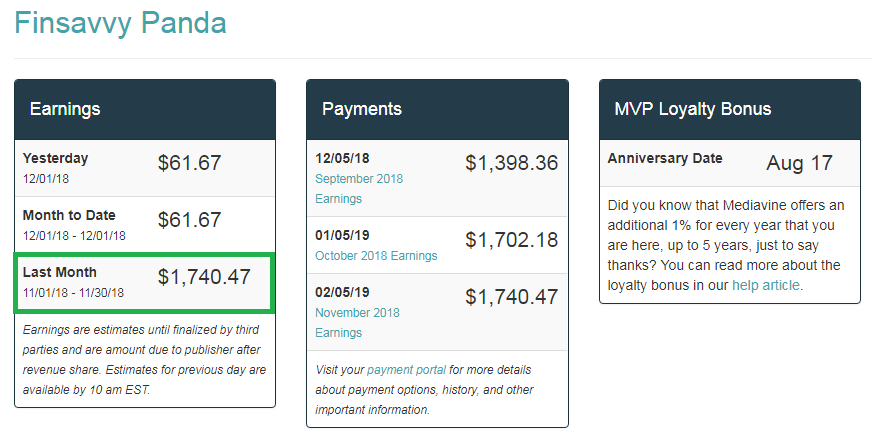

On top of making money with affiliate marketing (which I talk more about in my next point), I am also earning a pretty nice passive income stream with display advertising on my blog! This blog has been passively making over $1,300 per month with display ads alone.

Here’s proof from one of my screenshots:

UPDATE: After quitting my job, I made a lot of progress with this blog. From earning my first $100 blogging through Google AdSense, I reached a blog income of $5,000 per month within 12 months. And within 18 months, I became a six-figure blogger!

I make most of my blogging income through Pinterest and I share my tips on how you can you make money from Pinterest.

You can also check out how to start your own blog and make money here.

Again, I never thought this would be possible and I’m still really shocked!

I was able to build this blog while working a full-time job, and I want to tell you that you can too!

If you’re interested, you can sign up for my absolutely FREE 7-day email course on how to start a blog and make money from it. In this course, I teach beginners like you how to start your blog and launch it the right way so you can earn your first passive income online!

Blogging makes a great part-time income idea while working a full-time job!

You can also check out my very honest blog income reports where I log my blogging journey to show others that earning a passive income with a blog is possible! What I learned over the years is that you don’t need to be the best writer or an expert in what you blog about!

- How I Made $27,689.76 in a Month from Blogging

- How I Made $120,000 as a Full-Time Blogger in 18 Months

- November Blog Income Report: $5,532.13

- October Blog Income Report: $4,798.01

- September Blog Income Report: $4,509.50

- August Blog Income Report: $2,797.64

- July Blog Income Report: $703.57

- How To Make Your First $100 (Including $1,000) Blogging

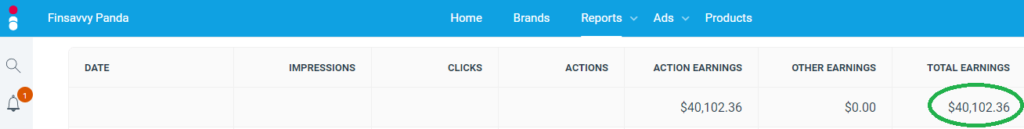

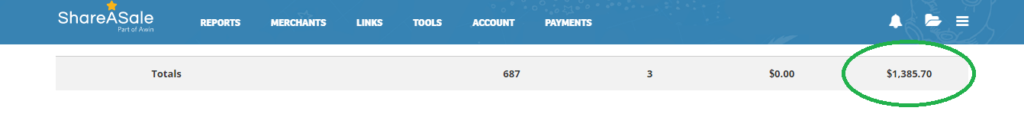

3. Earn money with affiliate marketing (how I earned over $40,000)

One form of passive income is earning money with affiliate marketing.

This concept is very new to me and it’s something I’ve been looking into because the idea is so intriguing!

Of all passive income ideas, this one catches my attention and it’s what I’ve been working on!

First of all, what is affiliate marketing?

If you don’t know, affiliate marketing is just referring products that you love and/or believe will add value to your audience. After they make a purchase, you earn a commission at no extra cost to your reader or audience.

There are tons of affiliate programs that allow you to earn a commission by promoting something you’re already using and/or believe will add value to the person you’re referring to.

For example, you’ll see that I’m always promoting one of my favorite books from Amazon, Rich Dad Poor Dad because it’s a very inspiring book I love that has completely changed my life!

Aside from good books, there are many products you can promote from Amazon Associates which is free to join.

If you want to learn more about affiliate marketing and how it works, I recommend starting a blog first (which only costs less than $3 a month) because this is how you can start recommending products on your blog. This could earn you a good passive income when you apply the right affiliate marketing strategies.

Here is a screenshot of two affiliate programs that I earn passively with my blog $40,102.36, and $1,385.70.

This is something I never thought would be possible but here is proof that creating a blog can help you earn monthly income from home!

Start your blog so you can get started with affiliate marketing!

Are you a total beginner and don’t know where to start? Join my FREE 7-day e-mail course where I will teach beginners like you how to start your blog so you can get started with affiliate marketing right away!

I would also like to mention that this course is NOT a get-rich-quick scheme! I’m not here to sell anyone a dream. I will reveal the initial steps I took (along with some honest truths about my journey) that helped me get to where I am today with this blog. Sign up and I’ll show you how I earn over thousands of dollars using affiliate marketing!

This is the course I wish I had when I first started my blog! 🙂

4. Rent out your stuff

This next passive income idea is pretty cool…

What if I told you that you could earn up to $1,000 every month by renting out your stuff? Fully insured as well!

Yes, such a thing exists and Fat Lama can help you with that (available in both the US and UK)!

This is what they call the “Airbnb for stuff”.

There are many people looking for things to use without having to pay full price for the item. That makes sense because why would anyone want to pay for things that they use occasionally?

Floor sanding machine, anyone? That was literally me a few years ago when I was looking for a machine to tackle on a DIY project!

This is where you can add value by turning the stuff you own into an income-producing asset!

For example, you can rent out the following items and make some passive income:

- DIY equipment

- Household tools

- Luxury outfits and handbags

- Drones

- Camera

- Video games

The list goes on and on because you can literally rent out almost anything you wish.

5. Make passive income while shopping

Sure, you can get paid to shop but that’s pretty active.

But what’s amazing is you can earn passive money by shopping for the things you normally shop for online.

I wrote an honest Rakuten review because the main shopping portal I use to earn money back on all my online purchases from stores like Sephora, Nike, Dell, Khol’s, etc.

This site has almost all the stores you shop at! That includes Apple, Nike, Adidas, Macy’s, eBay, Walmart, Staples, Expedia, and so much more! With that said, you can earn up to 30% on the things you already buy online.

🌟 Sign up here for your $30 welcome bonus after making your first $25 purchase through Rakuten.

If you live in Canada, use this link to sign up for your $30 bonus.

6. Invest in index funds or exchange-traded funds

One of the easiest and best ways to build passive income and make money while you sleep. I say it’s relatively easy because you don’t require a large amount of capital to start investing. As long as you have a steady income from your day job, you’re ready to invest in the stock markets through an index or exchange-traded fund (ETF).

Ok, you might be wondering what is an index fund.

Here is a definition I pulled out from Investopedia:

An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund provides broad market exposure, low operating expenses, and low portfolio turnover. These funds follow their benchmark index regardless of the state of the markets.

And now you might be wondering what is an ETF. I didn’t like Investopedia’s definition, so I’ll put it in my own words…

Like a mutual fund, an ETF owns and tracks the underlying assets (in our case, a bunch of company stocks such as ones in the S&P 500 index). Unlike an index fund, an ETF is listed on the exchange such as NYSE so it trades exactly like a stock. You can actually think of it as a stock that holds many company stocks.

How to invest in ETFs.

Before you invest in ETFs, you first need to identify your risk tolerance. Depending on whether you have aggressive, moderate, or conservative risk tolerance, you can choose from growth funds to funds that pay higher dividends. If you’re looking for the most passive option, those that pay higher dividends are the best choice.

You also have to consider if you can handle investing on your own. There are many options to start. You can do DIY investing or hire an advisor. Some people prefer not to spend high fees or aren’t confident enough in their skills. In that case, you can opt for a robo-advisor like Wealthsimple.

Wealthsimple is a well-established robo-advisor that’s available in Canada and the U.S. When you sign up on the website, you’ll be given a list of questions. Depending on the answers you give, they will help you invest in the appropriate funds. You don’t have to worry that what you’re investing in is too aggressive for you.

It’s also amazing because, with the help of Wealthsimple, you can maximize returns and minimize risks. These things aren’t guaranteed when you DIY. How do I know that Wealthsimple is the best route? Well, their investment approach uses a Nobel Winning Prize strategy created by Harry Markowitz.

7. Make Money on YouTube

More and more people are dreaming of becoming YouTubers to the point that there are already camps teaching kids to be YouTubers. As absurd as that sounds, it just goes to show how much potential YouTube has for generating income. I mean, some are making passive income at 16, like YouTuber Piper Rockelle.

Most of the famous YouTubers enjoy the work they’re doing because they’re sharing what they love with a community that thinks like them.

Just knowing all of these things is enough to attract anyone to become a YouTuber. But let me tell you something important: you won’t be able to make passive income right away. No one started a channel and earned money immediately. You will need to spend a considerable amount of time and effort to build an audience before income starts flowing in. If you’re all for putting in the effort until you succeed, then start turning your passion into profit with YouTube.

Start by thinking about what niche you’d most enjoy making videos of. One of my favorite examples is women who enjoy doing skincare have found success in becoming beauty gurus on YouTube. They offer practical skincare tips, showcasing their lifestyle from dietary choices to product use, and even detail their sleep patterns and positions to avoid sagging skin. If you’re obsessed with topics like skin-loving foods like avocadoes and nuts, or the best natural device like microcurrent or microdermabrasion, then this beauty niche is perfect for you!

On the other hand, gamers have also found a large engagement by streaming their games like Fortnite and League of Legends in addition to creating how-to guides.

Once you have a niche, consistently create valuable content until your channel grows. With enough followers and views, you can start earning on YouTube through ad revenue, sponsored content, and affiliate marketing.

8. Invest passively using your spare change

Mobile investing is becoming more popular every day and for good reason. One well-known micro-investing app is Acorns, which makes it easy for anyone, especially beginners, to start investing. This feels pretty passive and all you need is a little bit of spare change!

The app rounds up purchases made with linked credit or debit cards to the nearest dollar and invests the difference into a portfolio of Exchange-Traded Funds (ETFs). What an easy and passive way to save money! Instead of saving spare change in a jar or piggy bank, it goes into your Acorns account which helps you compound your low-effort savings!

Investing your spare change can be a great way to start saving for the future! In fact, my friend, Peter from Dollar Sanity has this post about the best Acorns Promotions and he tells you where you can sign up for a $10 bonus using a special referral code!

9. Invest in dividend stocks

Another relatively easy way to start your passive income journey is to invest in companies that pay dividends.

In simple terms, when a company such as Home Depot makes money (i.e. their earnings), they will distribute those earnings in the form of dividends (monthly, quarterly, semi-annually, or annually) to shareowners who invested in their stock. Dividends can be issued in terms of cash, stock payments, or in another form of payment. Either way, investing in dividends is a great way to build a passive income stream that will allow you to quit your job one day.

Note, however, not all companies pay dividends. For example, Amazon does not pay their shareowners any dividends because they still consider themselves a growth company. With that said, when you invest in a company like Amazon, you are looking for growth returns instead of dividend income.

For more information about passive dividend income, visit Tom @ Dividends Diversify where he speaks passionately about dividend investing. HINT: It was one of his secret weapons to quitting his job and retiring earlier than the average Joe. 😉

10. Invest in REITs

Real estate investing generally requires more capital upfront compared to stock and index investing, but it’s still very possible to build a passive income stream without having to own the entire strip of residential properties.

If you want to start making money from real estate without having to invest a lot of capital, there are many ways to achieve this. One way is through REIT (real estate investment trusts) investing.

According to Fundrise, an estimated 87 million Americans invest in and own shares in REITs. REITs give you the opportunity to invest in a portfolio of real estate. That generally includes commercial real estate such as offices, apartment buildings, shopping centers, warehouses, and hotels.

Similar to stocks, you can invest in a REIT through ETFs (exchange-traded funds). And similar to the ETF indexes that I mentioned earlier, REIT ETFs are also listed on major exchanges and trade like stocks. For example, here is a list of six popular REIT ETFs in the U.S.

In addition to the potential for moderate capital growth, REITs offer high dividend yields which make them great for passive income. The added benefit of investing in REITs is your exposure to real estate without hearing your tenants cry all night.

All of this may sound appealing, but it’s crucial to know that REITs, like other investments, are not risk-free!

For more information, here is how to invest in REITs.

11. Invest in rental properties

As I mentioned above, you can form passive income from real estate without physically owning a property by investing in REITs.

But, if you’re interested in becoming a landlord, you can consider earning passive income through physical rental properties. That’s if you don’t mind hearing your tenants cry once in a while, LOL!

After being homeowners and landlords for a few years, my fiance and I decided to invest in a second property.

A few years later, we invested in a duplex as a way to build equity and earn some extra income.

Now, I’ll be honest here. This isn’t 100% passive like REITs and there will be tenant issues that pop up from time to time. For example, we took a huge hit last summer when one of our tenants’ units got broken into. WORD OF ADVICE: never announce to the world that you will be away on vacation (I wish I could bluntly tell this to my tenants)! #FACEPALM.

Based on NY Post’s article, the writer says:

When on holiday or visiting family at Christmas, don’t advertise that your house is unoccupied. Wait until you have returned home to post pictures with your loved ones, or a burglar will have ample time to plan their theft.

Anyway, my point is that problems can and do occur. But like any other investment (regardless if it’s passive or not), there’s always a risk. The good thing is that most of the time, it’s been pretty passive based on our experience. KNOCK ON WOOD!

In the end, it really depends on the age of your property, location, quality of your tenants, as well as your relationship with them!

12. Rent out your space

When I was so frustrated from my 9-to-5, I started wondering how to make passive money without a job. I looked around and realized that the answer was in the separate unit I had.

I turned that extra space into passive income by renting it out to a family. We’ve been doing it for many years and because of that, we were able to cover our mortgage along with some utilities from the rental money alone.

You don’t even need a whole unit to earn passive income from your space. Do you have a room in your house that’s just collecting dust? Well, you can look for people who are willing to share the space with you. The income you earn from the spare room can cover your monthly bills or supplement your overall earnings.

On the other hand, it might require more work, but you can also rent out your spare room or space on Airbnb and make even more money. You’ll have to constantly attend to your guests’ needs and clean out the space, but it’s guaranteed that you can make more by having it rented on a per-day basis.

Managing rentals will initially demand some time and effort, but making use of unused spaces is a great way to cover your monthly bills and mortgage payments. For some, it’s even a primary source of income. So if you want to know how to replace your job income because you’re tired of slaving off hours of your life to a desk job, then start cleaning that spare room.

13. Open a High-Yield Savings Account

Though this won’t make you rich, the least you could do is park your emergency fund and/or your savings in a high-yield savings account. As you may know, emergency money isn’t meant for investing, so you may as well get some passive income from a bank that offers you high rates.

Traditional banks like Bank of America offer an extremely low rate of 0.01%. According to FDIC, the national average is 0.07%. Now, that’s just peanuts!

The great news is that CIT Bank, an online bank, offers one of the best rates at 1.55%! That’s 155x compared to Bank of America and more than 22x the national average! Also, rest assured that your deposit account at CIT Bank is FDIC-insured. 🙂

And don’t worry – I didn’t forget my Canadian readers. If you’re Canadian, I’m sure you’ll be super excited about EQ Bank because it’s known for offering the highest savings rate in Canada! Find out more about EQ Bank at Savvy New Canadians’ post, EQ Bank Review: No-Fee High-Interest Savings Account in Canada.

You might be wondering why these banks can offer such attractive rates. The reason is that they don’t have physical branches (like traditional banks) so they are able to pass those savings onto you in the form of higher rates!

14. Peer-To-Peer Lending

This is one of the most popular passive income ideas today and we hear about it a lot.

With peer-to-peer (P2P) lending, borrowers and investors register online and are anonymously matched.

Before I talk about P2P lending and how you can start earning passive income, first understand how it works from the borrower’s perspective.

P2P platforms like Lending Club would collect information about the borrowers when they sign up such as their age, education, income, credit score, etc. Then, they would assess each borrower and place them into different risk categories (i.e. from low-risk to high-risk.) Each P2P platform has its own way of assessing borrowers but you get the idea.

That information will then be released to potential lenders/investors (you) on the P2P platform. You would then choose who you want to lend your money to. Borrowers who are labeled as high-risk would give you higher potential returns, but that comes at a risk, and the reverse is true.

Now, here is an example of how P2P lending works.

Suppose a borrower named Johnny Default, requests to borrow $10,000. You, the lender, can choose to lend as little as $25, $50, $100, or even the full amount.

By the way, isn’t that great? You’re like the bank that charges Johnny Default an interest rate by lending him some money.

By putting in less than $10,000 (the full amount), you are spreading the risk with other investors who “crowdfund” to help Mr. Default. Alongside, you can spread your investment across many different loans (i.e. different borrowers) to diversify your portfolio. In other words, you lower your risks of a single default when you lend to different borrowers other than Johnny Default (e.g. Sally, Johnson, Ming, Bonnie, etc.).

With that said, P2P lending is a great way to diversify your passive income. But please note that reported returns of 5%-10% are not guaranteed. Like any other investments, there’s always a risk so you do your research before jumping the gun.

15. Rent out your parking space

Got a spare parking spot or storage space that you don’t use?

Great!

You can rent that out and earn some passive income. I have co-workers and family friends who rent out their unused parking space for $50-$200 per month depending on their location. Think about what an extra $50-$200 in passive income can do for you. 🙂

16. Place ads on your car

Of all the passive income ideas, this is one of the coolest ways to earn money while you sleep. Get paid for wrapping decal advertisements around your car. Companies such as Carvertise offer drivers about $100 per month in passive income with their campaigns lasting about three to six months.

17. Rent out your car

Do you have a car that’s not in use all the time?

If so, you can rent it out on Turo as a form of passive income. The concept is very similar to Airbnb’s peer-to-peer home rental program.

I read a story of how a man uses Turo for both his Tesla and Volvo XC90 SUV to cover his monthly payments, including insurance and parking.

On the flip side, you can also save money by renting someone else’s car when you plan a vacation. With that said, Turo is a peer-to-peer car-sharing program amongst strangers (just like Airbnb).

According to this article from CNBC, a Turo renter manages to make up to $14,000 per month renting out his cars. In that same article, it talks about it’s all about a great location and clever strategy.

Here are some facts about Turo on their website:

- Available in more than 4,500 cities

- Pick up at over 300 airports

- Over 800 car makes and models

- An average owner earns $720 per month

- An owner with three cars earns an average of $3,000+ per month

- Turo gives you a $1 million in liability insurance and they cover physical damage to the car

18. Get Paid to Post Ads

I love work-from-home jobs because I get to be flexible with how I manage my time. There’s no need for strict schedules or commutes. It’s even better when the job helps me make passive income! Well, since I’ve tried it, I want to share with you one of my favorite passive income jobs from home: posting ads.

For beginners, the most accessible way to start earning through ads is with Google AdSense. Google AdSense is a program that connects creators with ads that are relevant to their content. Google manages the ads, and all you have to do is post them on your website, blog, or YouTube channel, and you can start earning based on clicks or impressions generated by these ads.

As you can see, it’s passive because once people start clicking on the ads, you start making money. But of course, a solid online presence or platform is needed before you can earn a significant amount through ads. You will need to have substantial traffic on your website or blog. Otherwise, people won’t be bothered to check the ads on your website.

To achieve that, you need to focus on creating quality content consistently and growing an audience or community around your niche. You will have to attract more visitors and keep them coming back to you. It’s also important to maintain your blog so it remains attractive and relevant to your audience.

Don’t think it’s 100% passive. The truth is nothing is 100% passive without putting in some effort. You still need to work for the money at first, but once you have a dedicated audience, the money starts working for you.

If you don’t have a platform, you can still make money posting ads for other people. That’s possible by becoming a virtual assistant who posts ads on social media networking sites.

FAQs about passive income ideas

1. How can I make $1000 a month passively?

There are many alternative income opportunities to help you make $1,000 a month passively. Some ideas will work better for you than others would, but from my experience, the key to making $1,000 monthly is by diversifying your income streams.

Personally, I make over $1,000 in passive income monthly because I have a blog, rentals, and stock investments.

When I started a blog, I wasn’t earning passively right away, but after learning how to drive traffic to my blog through Pinterest and making some click-worthy pins, my income started to grow steadily. Through display ads and affiliate marketing, I’m able to make six figures a year from blogging even when I’m doing something else.

You don’t have to do the same things I do, but you should try more than one way to earn money. It’s important to put in a lot of effort and manage your income streams passively so you can do it consistently.

2. What are passive income ideas that actually work?

Almost any passive income idea that you think about will work as long as you manage it well. But of course, not all ideas will generate big earnings. There are some that I recommend more than others because they worked out well for me.

If you want to make extra money passively at home, starting a blog is a great way to kick-start that. This blog changed my life for the better. It was not passive at first (since you have to work on it), but once you’ve established it, you can start monetizing it and earn money even without actively working on it every day.

For example, I spent a lot of time creating high-quality content and building an audience before I was able to use affiliate marketing and display ads effectively. My blog income reports prove how I started from $100 to a six-digit income.

Investing is another idea that really works. You might be unsure what to invest in, but based on my experience, it’s best to invest in stocks and funds, as well as physical real estate. These are initially intimidating. I was honestly scared to try them in my early 20s because they seemed too complex. But once you understand the basics, it all becomes simple. Of course, you have to save and budget your money before you can go into high-risk investments.

3. How can I make $3,000 a month in passive income?

When you’re a total beginner, learning how to make $3000 a month in passive income may seem far-fetched, but I’m here to tell you that it’s an achievable goal!

I was broke with a lot of student debt while also paying off my car, and it felt like I was in a vicious cycle of living paycheck to paycheck. But focusing on saving money first, and finding ways to earn extra money on the weekends was my first step towards building a passive income stream.

While it takes time and effort to get started, having a steady stream of passive income can be incredibly rewarding. I’ll share my experience of how I achieved my first $3,000 in passive income a month when I first started my financial journey and explain the key steps you need to take.

For starters, it’s important to note that there are different types of passive income.

Generally, the most reliable and sustainable forms of passive income come from investing in assets like real estate, stocks, and bonds. These investments require upfront capital, but you can reap the rewards over time without having to actively manage them on a daily basis. For the most part, they can feel pretty “hands-off” depending on how you manage them. You can learn how compound interest in your stocks grows over time – yes, earning $3,000 per month passively through dividends, or even through stock appreciation is doable!

Aside from real estate, stocks, and bonds, another great way to generate passive income is by starting a blog and learning how to earn passive income online by using Pinterest alongside your blog.

Why?

Because you can further diversify your passive income with just one single website along with a couple of social media channels.

With a blog, you can definitely earn more than $3,000 per month, but this is how long it takes to make money blogging for the average person – usually within 12 months after building your website. However there are some who have achieved $3,000 per month in only 3 to 6 months.

Monetization methods for blogging include display ads, affiliate marketing, and creating digital products, such as e-books and online courses – all of which I do today with my website.

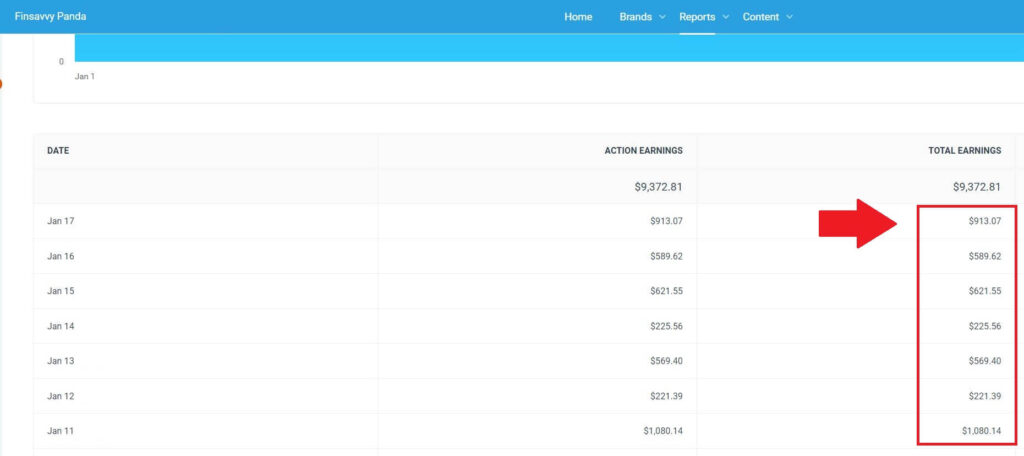

Here is a quick example screenshot of how much I earn on average in a single day with my blog, which feels quite passive – $500 a day. There are even times when I see my website making $1,000 a day! And yes, this could be you too:

Mind you, I started from $0 just like you! But as I invested my upfront time into blogging, I started seeing results!

Compared to real estate and stocks, it requires upfront capital. But with a blog, the investment is incredibly low but requires more of your upfront time. Perfect for you if you don’t have a lot of money to invest, but are patient and willing to put in your time and effort.

Starting a blog to make money (and to make it become more passive over time) is now my top recommendation! I am always excited about this topic, so you can learn more about how you can make money and earn a passive income through blogging in my separate post.

Enjoyed this post? Do me a huge favor and spread the love and follow me on Pinterest! 🙂

I was very happy to uncover this page. I need to to thank you for ones time for this fantastic read!! I definitely savored every part of it and I have you saved to fav to look at new information in your web site.

Hello, this is an intensive list on passive income. I really think that we should have alternative ways to earn especially with the current world situation that nothing is as stable as we thought. I have been reading about affiliate marketing as well as a means of passive income. Cheers to making more money passively!

@Finsavvy Panda:

Now you have gotten me considering even more seriously if to buy Michelle’s course. $400 is a great start!! A rental properties is something I think about often, but I haven’t been able to summon the courage to take it on yet…will see what happens.

Renting out my car? I should definitely give that one a look as well.

Thanks for the mention!!

My car is probably too ugly for Carvertise. And I drive a stick, so I’m not sure how many people would want to rent it on Turo.

I do some passive income. I make the most via t-shirts, but I also do Amazon Affiliates and Google Adsense. With those last two, I’m lucky if I make more than a dollar a month!

Hey Joe!

What?? If anything, I would think Carvertise is perfect for those who don’t drive fancy cars. Like, I can’t imagine those who have Audis, Teslas, or Corvettes wrap ads around their cars LOL!!

That’s awesome that the T-shirt biz is working out for you. I never looked into that but it is a very interesting idea. I’m also sure you’ll be able to improve your Amazon as well as Google adsense over time! You’re already doing a great job with your blog. Keep it up 🙂

P.S. it’s cool that you drive stick.