We will receive a commission if you make a purchase through our affiliate link at no extra cost to you. Please read our disclosure policy for more information.

Hey everyone!

I decided to write this post today to share some tips on how you can get out of debt fast. It doesn’t matter what kind of debt you have – credit card debt, car debt, or even student loans from school. Debt is debt, and I’m going to go through the steps I took to pay off my car and student loans while saving and investing my money at the same time.

I was burdened with a debt of around $70,000 after graduating and buying my first car, which, by the way, I am still using after 12 years! It’s how I save money by not switching cars. My parents didn’t make much, being low-income earners, so they couldn’t help me out financially like many people I know.

I was actually questioned by some of my peers from my school and work, who were shocked that my parents didn’t pay for my tuition or buy me a new car. They told me that it was odd hearing that I had to pay for these things because their parents gave them monthly allowances and gifts, which made me feel a bit self-conscious at the time.

Anyway, using my own experience, it took me a little longer to pay off my student loans compared to most people, about 7 years, as I didn’t follow the normal path that most people take, which is to immediately start paying off their debt as aggressively as possible.

Others who decide not to pay off their debts immediately have their own reasons and may have the question, is it better to save or pay off debt first?

To be quite honest, when I graduated from University, I didn’t feel much of a burden on my shoulders (which I think is crazy not to feel anything now, thinking about it), because I thought it wasn’t a big deal and that I could just slowly pay it off since rates were quite low during that time.

I think I was quite carefree and didn’t think about money the same way as today. Plus, as someone who majored in Finance and is influenced by how money works, I decided to save and invest first because I thought the return I could get on investments would be greater than the interest rate on my debt.

While I was paying off my debt, I also compiled a list of ways to save money fast, in addition to identifying 12 things I stopped buying to save more money.

The money I saved was then invested, which helped me reach my first $1,000,000 in net worth by the age of 33.

While that may have worked out for me, I have to admit that it’s more challenging in the current economic climate when interest rates are higher. So, if I were a graduating student today, I would most likely want to pay off my student loans as soon as possible due to today’s higher rates.

I know it can feel very daunting knowing the fact that you have some heavy weights on your shoulders, but I can assure you that with discipline, determination, and some patience, you’ll be on your way out of debt.

I’m here to encourage you all to take it one step at a time. Although I prioritized saving and investing over paying off my student and car loans, I still managed to pay them off and want to share tips on how I did it.

PIN (OR BOOKMARK) THIS PAGE: I’ll be updating this post so make sure to pin this image and save it to your Pinterest board. That way you’ll be able to come back to this page and learn how to get out of debt as quickly as possible.

How To Get Out of Debt Fast!

Being in debt isn’t glamorous. We all know that.

According to this article, almost 80% of Americans are in debt. That means for every 10 people you see on the street, 8 of them are in debt. And most of them are living paycheck to paycheck.

From time to time, you may hear about “good” debts vs. “bad” debts. Many people believe student loans to be a good debt because it’s an investment that will help you advance in your career, which increases your earning potential.

On the other hand, credit card debt is considered a bad debt because you’re essentially paying a crap load of interest just to consume things you cannot truly afford. Sorry, there’s no way of sugar-coating this but the first step to getting out of debt is acknowledging that fact.

Anyway, like I said: At the end of the day, debt is debt, and no one likes owing money despite it being good or bad.

Overall, debt prevents you from living a life of freedom. Instead of saving and investing your money — or splurging on a $6 Starbucks (but why do that when you can get free Starbucks?) — you’re worried about paying your next bill and wondering when this cycle is going to end.

Don’t worry, my friend. IT WILL END!

Here are 9 steps you need to take to get out of debt fast.

Related reads:

- Make Extra Money: How I Made Over $1,000,000 With These Side Hustles (which can help you get out of debt faster)

- How To Find Free Money

- 30+ Best Places To Get FREE STUFF on Your Birthday (Over $150 Value)

1. Acknowledge that you’re in debt and need help.

The first and most important thing is admitting that you’re in debt. And that’s okay as long as you’re making the effort to fix it.

The fact that you’re reading this means you’re already ahead of the Americans who haven’t been debt-free in more than 5 years. They might be paying their debt for the rest of their lives.

The sad part is that most people don’t want to know the truth so they avoid fixing the problem. They would rather bury their heads in the sand and blindly pay the minimum payment for as long as they can. Surprisingly, many of them don’t know that by paying the minimum payment, they are only digging themselves into a bigger hole.

But we know you’re not that person. You are different. You are facing your fears so that you can escape the vicious cycle of debt and living paycheck to paycheck.

Imagine the financial freedom you achieve after paying off your debts.

You’ll have the ability to build your savings and invest your money without having to worry about paying your next bill on time.

And just imagine the freedom of going out with your friends and splurging on things you enjoy without having to rely on that nasty credit card.

Wherever your imagination takes you, know that it’s not a dream. IT IS POSSIBLE and here’s what you need to do in order to make it come true.

2. Make a list of all your debts.

If you’ve gone this far, then kudos to you! Whether it’s student loan, car debt, or credit card debt, acknowledging the need to get out of debt is the most important step you’ve taken. That’s a huge deal!

Now, it’s showtime to line up those pesky loans like ducks at a carnival game—seeing them all means you’re ready to knock them down, one by one. It’s daunting, I know, but it’s doable.

Luckily, I made this debt summary worksheet here, so you can focus on listing and tracking your debts.

Much like creating a budget, you should start by listing everything. List all your dues under the “DEBT NAME” column (e.g., credit card #1, credit card #2, car loans). Even those small amounts that you owe from your friends should be listed! Never let a single cent come untracked.

Next, write the APR for each debt, the minimum payment, and the total outstanding balance in the designated columns.

When you write all of them down into one place where you see them together, it’s easier to see what and how much you owe. It will look like a mountain of debt, so it’s okay to be overwhelmed, but DON’T PANIC! Take a deep breath. You’re already taking proactive steps to fix the problem. As long as you continuously put in the effort and time to do something about the problem, you WILL get out of debt. You’ve got this!

Repeat after me: “Starting today, my debt amount will go nowhere but DOWN!”

Need help with saving money so that you can get out of debt?

Download our FAIL-PROOF Budget Kit to save money like a pro and get out of debt faster!

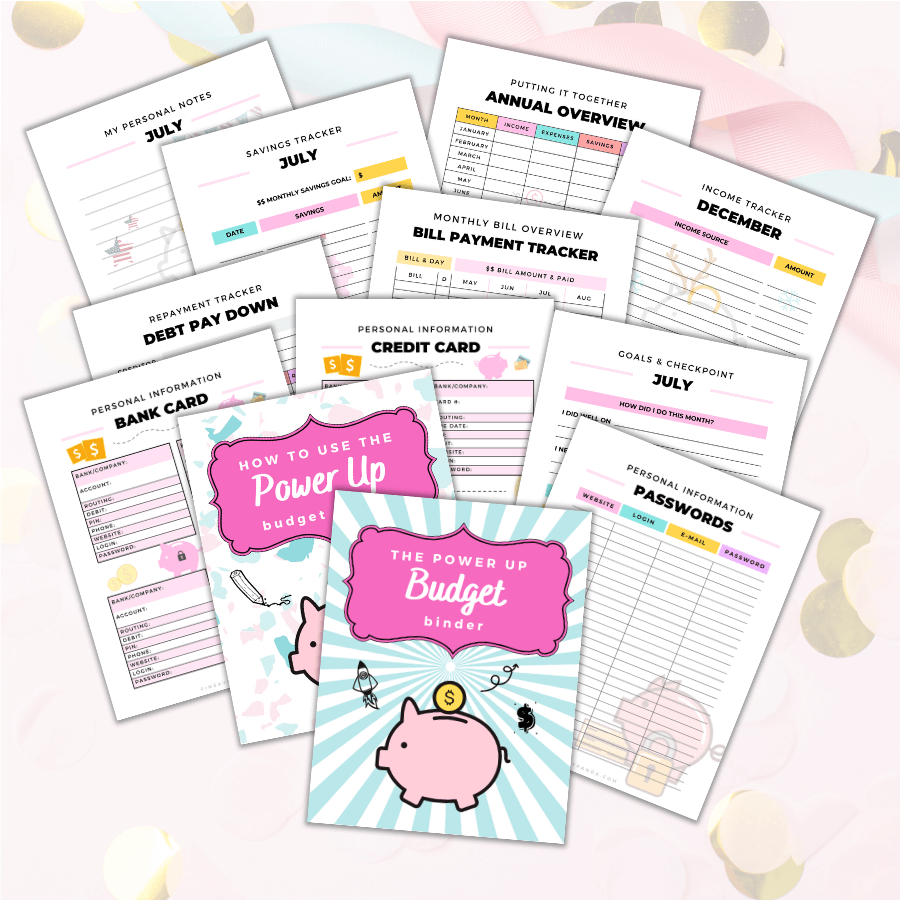

My husband and I were determined to achieve financial independence, so we started taking our finances seriously and created a budgeting strategy that worked wonders for us.

By following this plan, we saved our first $100,000 (over $200,000 combined) by our mid-20s. By our 30s, our combined net worth reached $2,000,000, all thanks to the strategies we used in our Premium Budget Binder – The Power Up Budget Binder, which costs only $42 for the upgraded and full version!

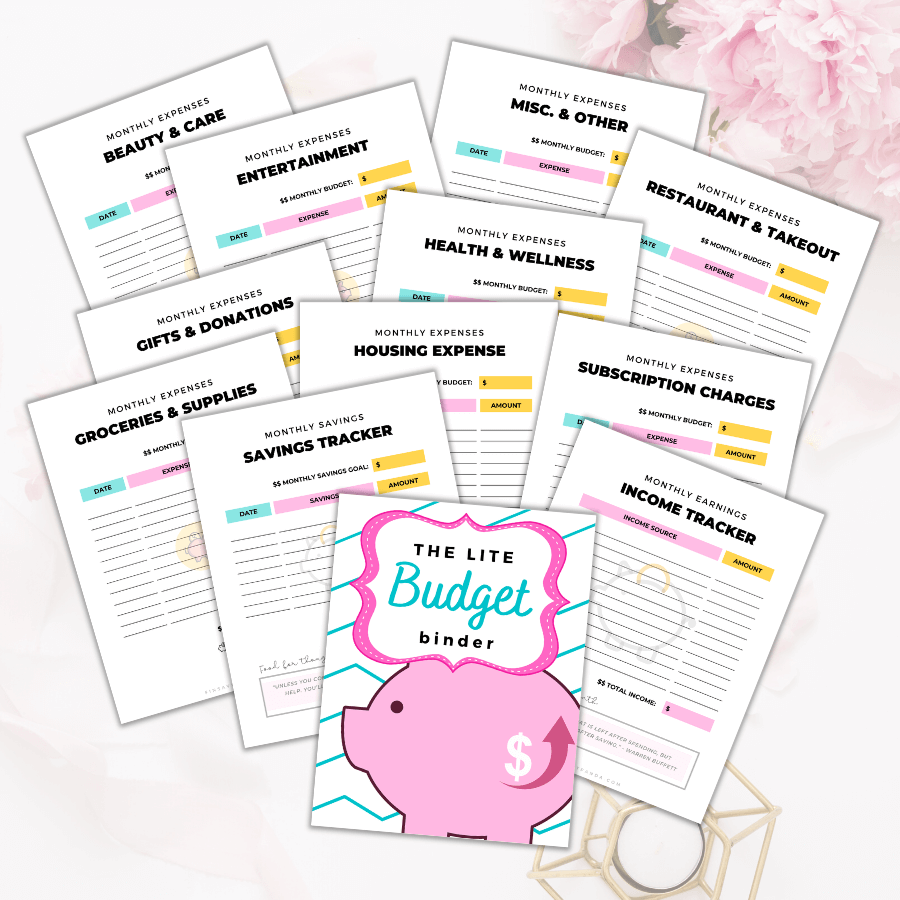

To help you master your savings, we’ve created these budget binders to reach your goals!

In this budget kit, we included a monthly budget tool that keeps track of all your income sources plus expenses. We also made these pretty weekly printables that will keep your budget and savings on track. These free printables were made to give you instant results to boost your confidence in your financial journey (whether you’re getting out of debt, saving money, or building wealth).

This budget kit is only exclusive to my subscribers, so grab your FREE copy here!

3. Negotiate your interest rates.

Did you know that you can save hundreds or even thousands of dollars just by lowering your APR?

There should be a contact number on the back of your credit card, so call them and negotiate a lower rate. According to this article from Bankrate, if you’re unhappy with your APR and want it lower, all you have to do is ask!

But before you call your credit card company, make sure to do your homework.

Even if it doesn’t work with the first call, don’t give up. Call again and give it another shot! Be persistent because that phone call could save you hundreds or even thousands of dollars!

4. Freeze your credit cards.

Now that you’ve negotiated with your credit card company, it’s time for you to freeze them.

Literally.

Freeze your credit with ice so that it becomes hard for you to access. This will make you second think whether melting that huge block of cube (which will take hours) is worth purchasing whatever you were going to purchase with that bloody card.

Another option is to cut them.

Do whatever it takes to stay far away from those credit cards.

5. Figure out how to pay off your debt.

Now that you’ve done all of the steps above, it’s time to figure out a debt payoff plan.

Generally speaking, there are two types – the Avalanche vs. Snowball plan. I personally prefer the Avalanche method because it’s rational, economically efficient, and saves the most money. However, numerous studies show that the snowball plan works well for the majority.

The fastest way to get out of debt is whichever one works better for you!

Let’s take a look at both, shall we?

The Debt Avalanche Method:

As mentioned, this method is rational and saves you the most money. How it works is you pay off your highest interest rate debt first. In other words, you tackle it in the order from highest to lowest until all of your debts are paid off. By tackling the highest interest rate loans, you’re essentially saving more money by paying less interest. However, humans, in general, are not always rational, and they need small wins to stay motivated, which we will talk about next with the snowball method plan.

The Debt Snowball Method:

This method is very popular and was emphasized by Dave Ramsey. Here’s how it works.

- Pay the minimum balance on all of your debts.

- Whatever money you have, put that towards the debt that has the smallest outstanding balance.

- Once the debt with the smallest outstanding balance is paid off, you move on to paying off your new smallest outstanding debt.

- Repeat this progress until your highest outstanding amount of debt is paid off.

What this essentially does is it gives you motivation and momentum through small wins.

As Dave Ramsey says:

“The math seems to lean more toward paying the highest interest debts first, but what I have learned is that personal finance is 20% head knowledge and 80% behavior. You need some quick wins in order to stay pumped enough to get out of debt completely.”

You can learn more about the debt snowball in Ramsey’s article here.

Which debt payoff plan should I choose?

Whichever method you choose is up to you. If you’re a beginner and the type of person who feels accomplished through small victories, I highly recommend going with the debt snowball plan! Even if you don’t save the most money with this plan, you’re still A LOT better off compared to not paying off any debts due to a lack of motivation.

6. Increase your debt payments.

Now, before you ask “how” and say “that’s impossible,” I want you to know that you CAN do it! It’s not impossible!

Here’s how you can increase your debt payments so that you can get out of debt fast!

- Save more money with these money-saving ideas.

- Earn extra money with these best side hustles.

Both saving and earning are surefire ways to pay off your debts quickly! Let me go through each of these in steps 7 and 8 below.

7. Find ways to trim your expenses without depriving yourself.

Instead of cutting on small things you enjoy, such as that $2 coffee, find bigger expenses to shave that will help you get out of debt quicker. You may not need to cut them out completely as long as they’re adding value to your life, but as I mentioned in step 3, you can always negotiate your bills with your service providers. The more you save, the faster you can pay off your debt with those savings!

Below are some expenses you can cut and/or negotiate:

- car insurance.

- home insurance.

- monthly subscriptions (e.g. cable, magazines, Internet, LinkedIn, etc.)

- ATM and bank fees.

- overdraft and late fees.

8. Find ways to earn extra money to pay off your debt.

As you know, there’s a limit to how much you can save, but there’s no limit to how much you can earn!

With that said, you need to find ways to boost your income and there’s no excuse!

Some people will complain and say:

- “How? I work a full-time job, and I don’t have time.”

- “I don’t have the required skills to make extra money.”

- “There’s no way because I have a family and kids to take care of, so there’s no time for another job. I have a real life here!”

But, I know you’re not that person who makes those phony excuses. You and I both know that you are determined and YOU WILL do whatever it takes to get out of debt fast!

Are you ready to earn extra money so that you can start living the life you want?

I bet you are!

Here’s how to earn more so you can pay off your debt sooner!

How to earn extra money through side hustles so you can pay off debt:

When I was a graduating student paying off my debt, one of my favorite sites to earn a bit of extra money (or redeem free gift cards) was Swagbucks. You can get FREE gift cards or cash (your choice) by watching fun videos, surfing the web, taking surveys, and more!

I personally love using this site to redeem my free $25 to $100 Starbucks gift cards!

Swagbucks is 100% legitimate and has paid out their members over $995,716,867 to date.

GET A FREE $5 BONUS RIGHT NOW: You can sign up using this special page and get your FREE $5 bonus. It’s totally free to join! Also, be sure to hit the “confirm” button in the confirmation e-mail you get from Swagbucks to secure your $5 welcome bonus!

In fact, there are many side hustles I’ve done like taking paid surveys online, flipping furniture, flipping clothes, selling crafts and home decor items that I created from home, renting out my space, and many more.

Despite earning a full-time six-figure salary income from blogging, I’ve also done food delivery for fun through apps like DoorDash.

Here are other surefire ways to boost your income NOW!

- The 15 Best Survey Sites That Actually Pay Cash (Earn Up To $50 Per Survey)

- Side Hustles I’ve Done To Earn Over $1,000,000 (#1 can be life-changing)

- Legit Ways To Make Money Online For Beginners

- Best Passive Income Ideas That Make Money While You Sleep

- Best Ways To Earn Free Gift Cards and Money Online (Amazon, Walmart, Starbucks, Visa, and more!)

How To Increase Your Current Salary:

Another way to earn more is to increase your salary. It’s possible to increase it by hundreds or even thousands of dollars just by having a quick chat with your boss. What a fantastic way of paying off your debts sooner!

One of my favorite FREE resources is Ramit’s Ultimate Guide To Asking For a Raise and Negotiating Your Salary. His free e-book is extremely helpful and will give you (almost) instant results! You need to check this out if you want to boost your salary, stop living paycheck to paycheck, and improve your lifestyle!

9. Celebrate your small wins.

I’m not sugarcoating anything here: trying to be debt-free isn’t a walk in the park. It feels more like a rollercoaster ride that leaves you feeling sick. One loop makes you want to just end it.

It’s so easy to be discouraged when the ride makes you want to give up. Once you’re discouraged, it’s hard to keep going. That’s why it’s so important to celebrate your small wins.

Did you make an extra payment on a loan? Or maybe you made a payment way before the due date? Those are all grounds for celebration. Reward yourself even for the little things.

If you want to spend a whole evening reading your favorite thriller book, go ahead. Treat yourself to your favorite ice cream flavor if it would cheer you up! Depriving yourself of life’s little pleasures is never a good idea. Even if you have to spend a bit of money, go for it. Don’t let the goal of becoming debt-free make you miserable.

The whole process is challenging, but as long as you commit to it, you can achieve a debt-free life.

Don’t miss out on FREE money over here…

If you follow my blog, you will know that I’m all about saving money and making money. Below are some of my favorite sites and resources that may help you! The best part is that they’re all FREE to join!

Swagbucks allows you to earn cash and FREE gift cards just by surfing the web (like how you search for things on Google), watching videos, playing games, and completing easy surveys. Check out the gift cards they offer here.

My fiance and I have redeemed many $50 to $100 Starbucks gift cards which helped us save money and reduce our spending! It also helped us earn free Amazon gift cards for holiday spending.

Rakuten: You get FREE cash just for shopping at over 2,000 of your favorite stores. This includes Walmart, Macy’s, Apple, Kohl’s, Target, eBay, and so many more! I use Rakuten to save over a few hundred dollars just for shopping for the things I normally buy.

🌟 Sign up here for your $10 welcome bonus after making your first $25 purchase through Ebates.

If you live in Canada, you must use this link to sign up for your $5 bonus.

Related post: To learn more, read my full review and tutorial on how to use Rakuten. You’ll seriously LOVE Rakuten as much as I do!

I sincerely hope that this article keeps you motivated in your debt-free journey. Just remember, you got this!

Enjoyed this post? Don’t forget to share it and follow me on Pinterest! 🙂

I’m in a tight spot and need some advice.

We just bought an older house with a rental suite that pays for over half our mortgage. We put all our savings into repairs (most of the fixes were desperately needed, like fixing electrical that had previous fires). Now within a month of completing the renovations, our car broke down (which hubby requires for his job), he lost a major client so we didn’t get an expected paycheque,and our long term tenants bought a house and are moving out at the end of the month and we haven’t had any luck finding a new tenant.

At this time we have maxed out our credit card and our line of credit, we have over $4000 in bills every month (almost half of that should get covered by tenants paying rent) and our next paycheque has been put on hold for up to a month because of the current postal strike.

This autumn is the first time, in our 15 years of marriage, that we’ve ever been in debt (other than our mortgage) and in the last few months we went $21,000 into debt. Between emergency expenses and lack of income, it feels like our only option is to sell our house but we spent the last 15 years in a dangerous neighbourhood in a tiny old 2 bedroom townhouse and I just can’t imagine bringing the kids back to that.

We borrowed money from my parents for one month of expenses, but then we’re on our own… The next mortgage payment is coming quickly and the bank account has just enough to pay back the tenant’s damage deposit.

Do we give up and sell? Or is there a way that we can pull through for a couple of months till we have new tenants and work gets back on track? We are trying to get second jobs and make money on the side, but we live in a tourist town and no one seems to hire during winter months, and even if we get something, we won’t get paid before our payment is due.

Another way to payoff your debt a lot faster to to consolidate all your high interest debts into one low interest loan. Once you do that, even if you are paying the same amount every month, the principal that you pay down will be faster.

If you can’t consolidate, balance transfer is another option too. Most institutions will only charge you 1% for a year for your balance transfer and charge 1% transfer fee. This is a lot lower your than paying a 20% interest.

Nice list!! As long as you have a plan to pay off your debt, that is a great start on getting your way to pay them off. And like you said, staying focus is the key to paying off your debt. When you keep at it, your debts will be wiped out before you know it.