We will receive a commission if you make a purchase through our affiliate link at no extra cost to you. Please read our disclosure policy for more information.

Hey, my friend! I’m Ling, the owner of this personal finance and lifestyle blog, FinSavvy Panda.

I’ve been featured as a financial expert on sites like Yahoo Finance, MSN, GoBankingRates, Wealth Simple, RentCafe, and more.

Way before I embarked on this blogging journey, which has become a fun and profitable hobby for me, I was burdened with a load of student debt. I totally get what it feels like to struggle with spending habits. I used to constantly tell myself, “I just can’t stop buying things!”

But over the years, I picked up some valuable habits and reached a point where I successfully kicked the habit of excessive spending and started saving money instead!

It got to a point where my family and friends started considering me a money-savvy person, often seeking my advice on how to save and resist unnecessary purchases. They’d ask me things like, “How do you manage to save money?” and “How do you stop yourself from buying unnecessary things you don’t really need?”

I usually tell them that I’m always having fun looking for creative ways to make $500 a day and that learning how to make some passive income streams will make saving feel a little easier. That includes investing all the money I saved from the things I stopped buying.

However, aside from finding side hustles and diligently investing my money, I could still say that curbing bad spending habits and being more mindful about my spending helped A LOT.

So, this is what I REALLY realized when I spent some time thinking about my past purchases…

Many of those unnecessary purchases are related to eating out, unhealthy food disguised as being “healthy,” clothing, home expenses, beauty products, and random kick-knacks that I use on a daily basis. They are also items that put you under financial strain.

A lot of these things were also silently messing with my health, both in body and mind, and I had no clue because I didn’t feel sick or in pain. They’re like quiet health thieves that no one really knows about or discusses. Honestly, I eventually realized that businesses are keeping us in the dark about the harm their products can do, just to keep our cash flowing their way, all while never truly fixing the root issues we’re dealing with.

When I found out that a bunch of big companies are just feeding us a load of crap, I immediately researched more into stuff like money matters, food, clothes, health, and skincare products. And man, was I so angry with myself… only to find out that I wasted thousands of dollars over the years—just like a lot of us do without even noticing how it all adds up.

These are the things I’ll be mentioning today in this post and I hope you find them helpful in improving not only your personal finances but your overall lifestyle too!

The result is, I ended up saving WAY more money than I could have imagined once I became more mindful and intentional about where my money goes.

How To Stop Buying Things You Don’t Need

I went from saving my first six figures, $100,000, by the age of 26 to saving and accumulating over seven figures net worth in my 30s, all because I did most of what I will be discussing in this article today.

If you follow my blog, you’ll know that I’m not a fan of cutting things I enjoy. Definitely not!

Instead, I paid attention to the unnecessary purchases that didn’t add any value to my life.

Here is the list of things I stopped buying to save money and live better!

I want to point out that tip #1 helped my fiancé (now husband) and me save money without having to cut back on those delicious Starbucks coffee drinks we enjoy!

On top of that, you can read my story of how cutting cable and HGTV channels made a huge difference to not only my bank account but my life as well! I honestly didn’t expect that coming.

And one of my pastime hobbies is blogging on this blog, as well as implementing self-care and skin-care on a budget without spending thousands of dollars which range from eating healthy and exercising to being mindful and grateful for what I have.

I finally manifested my dreams of saving 7 figures and I’d love to share these tips to improve your life too! I hope you enjoy this post!

PIN (OR BOOKMARK) THIS PAGE: I’ll be updating this post for more tips, so don’t forget to save and pin this post HERE on Pinterest so you can always refer back to this list. This will help you overcome spending so you can finally save more, live more, and become finacially indpendent! 🙂

1. Reduce your spending by earning FREE gift cards to Starbucks.

Okay, so I did not stop buying my favorite drinks from Starbucks!

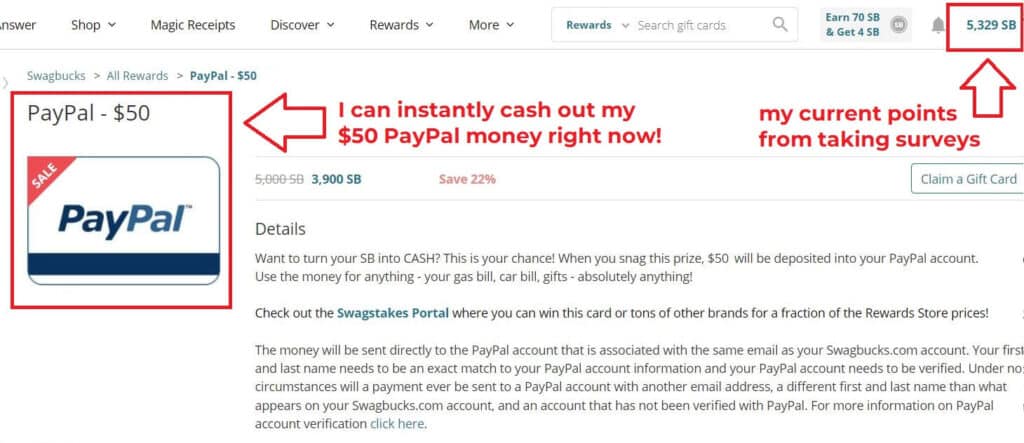

I’m able to save money and reduce my spending because my favorite money-saving resources, like Swagbucks, allow you to earn FREE gift cards by watching videos, surfing the web, shopping for things you normally buy, playing games, and completing surveys!

I always get so excited when it comes to redeeming those FREE $50-$100 Starbucks gift cards!

Yep, the small and quick wins make me a happy gal. 🙂

In addition to Starbucks gift cards, I like how they offer other gift card selections like Amazon, Walmart, and more!

This is one of the most well-known and popular surveys and cash rewards programs in North America. It’s absolutely free to use!

Swagbucks is 100% legitimate and has paid out its members over $921,087,343 to date! I’ve been a Swagbucks user since 2009 and I recommend them to those who want to earn free gift cards.

You can get a FREE $5 bonus from Swagbucks here just by signing up today. 😊

⭐️ Important: Make sure you verify the email from Swagbucks in your inbox so you can get your FREE $5 bonus and start earning free gift cards immediately!

2. Cutting cable helped me make money.

According to US News, cable can be priced as high as $217, which is more than what most people pay for other major utilities combined. What’s even more surprising is that the price of cable service has increased by more than 50% in the last couple years. And here we thought everyone was just using streaming services.

Though our cable bill wasn’t that high, we still stopped spending $55 per month ($660 per year) because we were barely using the service.

Even when I was using our cable service at times, I would binge-watch my favorite HGTV shows for many hours which led me to feel sluggish and unaccomplished for the entire day!

TRUST ME, once you find more meaningful activities to do during your free time, you’ll save money and won’t miss cable at all!

How to stop buying things:

After I ditched cable and focused on hobbies that make money, I naturally stopped spending money on unnecessary things within the past year (without even noticing)!

One of my favorite activities to do today is blogging! In fact, since I started a blog, I stopped spending money on unnecessary things and managed to save a TON of money!

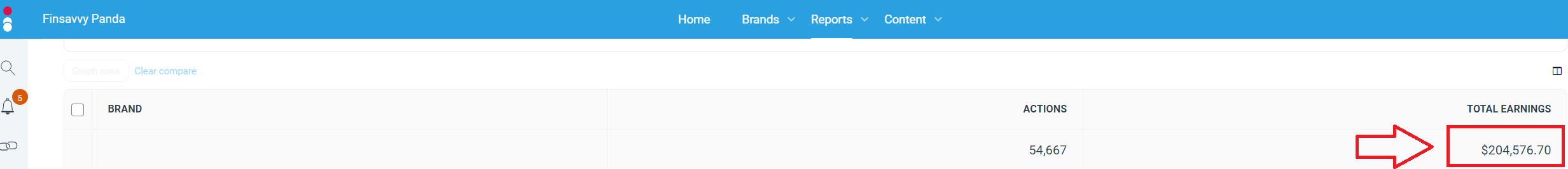

Plus, I’m now able to make $20,000+ per month online with my small blog! 💰 Feel free to check out my blog income reports and just imagine what this extra money could do for you.

Could this amount of money help you pay off some debt, pay the monthly bills (on time), or perhaps save money for your other financial goals? You can decide! 🙂

There are many ways to make money blogging, but you can see in the screenshot below just one example of how I made money online by working on this blog in my spare time:

⭐️ If you asked me over a year ago, I had absolutely no clue that blogs could make money! I didn’t even know what blogs were! You too can learn how this small blog makes money online using Pinterest.

In fact, you can get started with my easy step-by-step tutorial on how to start a profitable blog here.

UPDATE: I have an exclusive FREE Start A Blog 7-Day Email course here that will show total beginners like you how I built my small hobby blog to $120,000 per year in my second year of blogging! I’ve helped over 10,000 students start their blogs and I would love to see you succeed in this too!

In the end, I was so glad to find this perfect alternative to watching TV! 🙂

That brings up my next point…

Do you know how many hours of TV the average American watches per day?

Five hours and four minutes per day!

Geez, that’s almost a full-time job according to The New York Times!

Don’t get me wrong, I’m not saying that watching TV is bad.

Just too much of it makes you become sluggish and unproductive according to a Forbes article I read. That’s exactly why I watch less TV these days!

BTW, I’m not saying you have to cut cable. I personally made the decision to get rid of it because I really enjoy blogging (and making extra money from the blog) during my spare time.

3. I stopped pleasing people and saved over 7 figures.

Whenever friends or coworkers casually suggest going out for dinner or drinks without a particularly compelling reason, I tend to politely decline. Not that I’m not interested, but my lifestyle has shifted in a healthier direction.

I’ve consciously reduced the frequency of eating out as I try to avoid junk food, which I only save for special occasions. I’m also not much of a drinker since I know how bad it is for the body and how much it can age your appearance. It’s not that I don’t appreciate these activities, but in excess, they tend to sap my energy. Plus, the cumulative costs are hard to ignore!

Instead of joining them every Thursday or Friday night, my spouse and I devoted our time to hunting for rental properties. We frequently arranged meetings with our realtor and have had engaging discussions about investment properties over a cup of coffee.

While our circle of friends and family were out eating, drinking, and buying things like fancy gadgets and electronics all the time, we were diligently pursuing opportunities to grow our wealth using the money we saved over the years.

Truth be told, if it wasn’t for our investment-minded approach to our savings and a dedicated focus on building assets, we wouldn’t have been able to amass our own seven-figure nest egg today with diversified assets including real estate.

People initially laughed at us and thought we were crazy because they didn’t think we could build wealth from scratch especially when my spouse and I had come from poor and low-income families; along with that, we had to pay off our hefty student loans from school. When we explained the concept of “compounding interest” to our friends, they were confused and showed no interest.

But over the years, those same people have been shocked at how much we saved and began turning to us for guidance on how to invest and build wealth. Many have even asked us how to start a money-making blog online!

Hey, friend! Do you want to earn some free money now?

Are you a beginner who’s intimidated by the idea of saving and making extra money? I used to feel the same way! However, I began by taking small steps, starting with online surveys that pay you for your opinion.

One survey site I highly recommend is Branded Surveys which has over 3 million members and growing. In addition to you earning extra cash, it can also help you save on purchases at popular retail stores you love when you select their free Amazon gift cards.

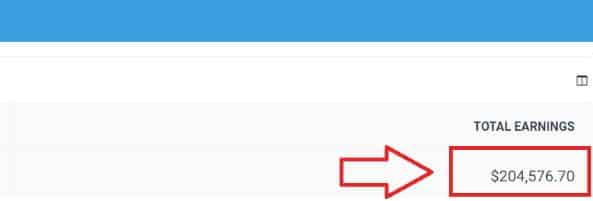

Here’s a screenshot of the points I’ve earned from taking surveys on sites like Swagbucks, which I can instantly redeem right now for $50 in PayPal cash. If PayPal ain’t your thing, you can easily swap that for a free $50 Amazon, Walmart, or Target gift card.

This $50 PayPal cash (or gift card) can be yours too when you start doing simple surveys!

👉 When you sign up for Branded Surveys today using this special page, you’ll also instantly get a welcome bonus of 100 points! It’s absolutely free to join and I recommend signing up now!

⭐️ Important note: Just make sure you verify the email from Branded Surveys in your inbox to snatch your welcome bonus points!

4. Eating out too often.

Pin this image on Pinterest here for more actionable tips on how to stop buying unnecessary things, so you can reach financial independence sooner!

Before making trips to the grocery store, we used to dine out for breakfast, lunch, and dinner almost every single day! When we reviewed our past bills, we were spending over $20,000 on food each year.

I know you might be reading this and thinking: “What??? That’s insane. Impossible!”

We even asked our friends and coworkers to add up their annual food costs (groceries, takeouts, restaurants, drinks, snacks, etc.) and they were shocked at how much they were spending! 😦

So, before you jump to conclusions, here is a breakdown of our personal food costs NOT including snacks, special drinks, or appetizers!

I even DOWNPLAYED our own numbers just to not scare you away! Trust me, once you pull out your receipts, you’ll be SHOCKED at how much you’re spending on a daily basis! Numbers DON’T lie!!!

UPDATE 2023: This table reflects prices in 2022 whereas the other table reflects prices from 2018.

| Breakfast & Tea | Lunch | Dinner | Total | |

| Monday | $8.00 | $13.00 | $15.00 | $36.00 |

| Tuesday | $8.00 | $13.00 | $15.00 | $36.00 |

| Wednesday | $8.00 | $13.00 | $15.00 | $36.00 |

| Thursday | $8.00 | $13.00 | $15.00 | $36.00 |

| Friday | $8.00 | $13.00 | $15.00 | $36.00 |

| Saturday | $8.00 | $20.00 | $50.00 | $68.00 |

| Sunday | $8.00 | $20.00 | $50.00 | $68.00 |

| Weekly Total | $56.00 | $105.00 | $155.00 | $316.00 |

| Yearly Food Cost Per Person | $17,472.00 | |||

| Yearly Food Cost Per Couple | $34,944.00 | |||

This table below is using 2018 prices, so you can probably see how much they have gone up in the last 4 years. Inflation sucks!

| Breakfast & Tea | Lunch | Dinner | Total | |

| Monday | $5.00 | $10.00 | $12.00 | $27.00 |

| Tuesday | $5.00 | $10.00 | $12.00 | $27.00 |

| Wednesday | $5.00 | $10.00 | $12.00 | $27.00 |

| Thursday | $5.00 | $10.00 | $12.00 | $27.00 |

| Friday | $5.00 | $10.00 | $12.00 | $27.00 |

| Saturday | $5.00 | $12.00 | $35.00 | $52.00 |

| Sunday | $5.00 | $12.00 | $30.00 | $47.00 |

| Weekly Total | $35.00 | $74.00 | $125.00 | $234.00 |

| Yearly Food Cost Per Person | $12,168.00 | |||

| Yearly Food Cost Per Couple | $24,336.00 | |||

It’s insane because we thought we were just “living a normal life.” That’s actually quite common when you live in an expensive city.

After realizing how much money we were wasting, we started packing our lunches and making meals at home.

Today, we balance eating in and going out. To be honest, we enjoy this lifestyle much more because we start to appreciate the foods we eat when we go out to special restaurants!

I highly recommend you to review your personal food costs to see how much you’re spending as well! You might be shocked yourself but the numbers don’t lie!!!

Just look at this father who maxed out 8 credit cards because his family always eats out! Luckily, the family got the help they needed to pay off their debt.

The $5 Meal Plan!

If you don’t know how to meal plan, or the idea sounds too overwhelming, I highly recommend this $5 meal plan service which will help you save time and money! 🥙🌮

This is simply a weekly meal plan service that aims to make your life SUPER easy and stress-free!

For only $5 a month, you’ll receive a delicious meal plan that costs less than $2 per meal. Stop dining out often and start saving AT LEAST $400 every month per person!

Again, my fiancé and I saved over $11,000 in a year when we reduced our food expenses!

If you’re not sure whether this meal plan service is right for you, they offer a FREE 14-day risk-free trial here for you to test out.

They’re very serious when it comes to customer satisfaction. So if it doesn’t work out, you can cancel at any time without ever spending a cent. Absolutely no questions asked!

With that said, we stopped dining out so often to save more money!

5. I quit buying Sephora and high-end makeup products

To save money, I stopped buying so much expensive makeup and other products from Sephora and high-end department stores.

I’ll admit that this wasn’t easy at first. But I was serious about saving money so I bought less and less of their products by only sticking to a few expensive ones that I absolutely LOVE!

Generally, I splurge on expensive foundation and skincare because they go directly onto the skin (plus I look for ones that aren’t filled with toxins that are harmful), but I started using other alternatives for some products that aren’t as important to me.

For example, I spend very little on mascara like the Maybelline Colossal Curl Bounce in the “Very Black” color. This is SO much more affordable and it works just as well as expensive ones! 😲

🌟 PRO TIP: When I do spend, I would take advantage of money-saving resources like Rakuten to get FREE money back on my purchases from Sephora along with other stores I usually shop at. I really LOVE Rakuten and I always recommend them to my family and friends! It’s 100% FREE to use too! 💵

👉 Check out my honest Rakuten review (plus get a FREE $10 bonus). This covers a quick tutorial on how you can save money on your day-to-day purchases at over 2,000+ stores WITHOUT putting in effort. NO gimmicks at all!

I still look the same and never felt any prettier by buying more makeup. The only difference is I save hundreds of dollars by being more mindful and intentional with what I buy.

With that said, I choose to save money so that I could invest in stocks and other investments that give me capital returns. 🙂

6. Expensive and overhyped skin care products costing you over $1K/Year!

Here are things you should stop buying to save money – expensive and overhyped skin care products that don’t work!

According to Yahoo Finance, women spend nearly $1K per year on their appearance. This number may even be understated because I read a lot about this topic and I actually witness women who spend more than just thousands of dollars on beauty and skincare products (without honestly disclosing or even realizing it).

So, this section will be long. But it’s packed with raw and authentic information as I was a struggling female who was a victim of wasting money in this category due to false advertising and marketing claims.

Continuing from my previous point about makeup, I also stopped buying certain skin care products that were not only insanely expensive but also VERY damaging to my skin in the long run!

What I wasn’t aware of is that many beauty companies are full of lies and deceit regardless of the insane number of positive reviews about those products, like the SK-II line along with many other Korean brands that aren’t as good or as ethical as they claim to be. I seriously got scammed!

Expensive and popular products do NOT equate to quality or results. And it’s not just about buying some random collagen supplement or slapping so-called miracle creams on your face. EXTREMELY FAR from it!

After doing a ton of research about the skin and the best products for many years, I realized (and witnessed) that the foundation for beautiful and youthful skin (on an affordable budget too), is following these skin-care practices in the order of importance. You’ll be surprised to hear that creams and serums are just icing on the cake.

All of these points are essential, and this advice really WORKS at reducing wrinkles, sags, hyperpigmentation, dark circles, etc. if you do them all consistently on a daily basis:

- Sunscreen: Wear sunscreen on the face every single day, despite rain or shine, 365 days a year. Yes, including the fall and winter because UVA rays from the sun are the silent killer and what causes skin aging! So, only invest in a broad-spectrum SPF 50+ sunscreen because “broad spectrum” protects skin from both UVB and UBA rays. My favorite sunscreens are Beauty by Joseon and EltaMD UV Sport Broad-Spectrum SPF 50.

- Sleep: Sleep is one of the best and most underrated medicines for your body and skin so get 7-8 hours every night! They call it “beauty sleep” for a reason. No number of in-office procedures or $100 face cream can ever fix this! Plus, sleep is totally free and costs you nothing.

- Manage your stress: You’d be surprised at how stress can deteriorate your skin over time without you knowing. And I can guarantee spending money on the most expensive skincare won’t fix this if you don’t fix your stress first. You can manage stress through exercising, meditation, deep breathing, mindfulness, or whatever it is that works for you. Choose a hobby or exercise that keeps you calm and relaxed. This costs you nothing too!

- Eat healthy: I mentioned that junk foods are one of the many things to stop buying to save money. So, swap junk foods with an affordable healthy, and well-balanced diet filled with skin-loving nutrients. That includes but is not limited to avocadoes, seeds, nuts, beans, fish, goji berries, and dark chocolate without sugar, in addition to fruits and vegetables filled with antioxidants, especially tomato-based products due to its potent antioxidant, lycopene.

- Stop spending money on foods with added sugars and bad carbs: I’m NOT saying go no-carb or low-carb because carbs are made differently and our body needs them. In the past, most of my money was wasted on foods like pasta, rice, pastries, white starchy potatoes, lasagna, unhealthy snacks, desserts, pre-made salad dressings, etc. which damaged my skin so badly! That even includes foods that are marketed and disguised as “healthy” but are truly bad for your skin, which no amount of skin care procedure or product can fix! The sad part is that 90% of this standard American diet causes something in your body called “advanced glycation end-products” which coincidently has the acronym of “AGES”. In simple words, “glycation” is sugar damage that makes your skin wrinkly, dull, weak, and YES, ages you! Sugar and bad carbs like white bread and pasta accelerate the aging of your skin, so I stopped wasting money on these foods. The result is I saw a significant improvement in as little as 1 month of implementing a healthy (still affordable) diet into my lifestyle!

- Take care of your bones (because your skin cares): Bones are one of the lesser-discussed topics when it comes to skincare and anti-aging but extremely important. I think the skin-care industry doesn’t want you to know so that they can continue to milk money off of you with their other skincare products that never work. I won’t go into details but just know that looking after your bones isn’t expensive as long as you are following a healthy diet that consists of the right amount of calcium, vitamin D, vitamin K2 (via fermented foods like natto beans, kimchi, sauerkraut, etc.), magnesium, and other vitamins and minerals. In addition to that, resistance training exercises and lifting weights will also help preserve your bones, which costs you nothing! Facial yoga exercises and DIY facial massages may even help when you do this consistently every day!

- Exercise: Exercising, even if it’s as simple as walking every single day or doing jumping jacks and 15-20 push-ups throughout the day, promotes blood flow throughout the body. According to WebMD, “Blood carries oxygen and nutrients to working cells throughout the body, including the skin. In addition to providing oxygen, blood flow also helps carry away waste products, including free radicals, from working cells”.

- Know your skin type: Find out and understand your skin type and what you can or cannot tolerate. Are you oily, dry, or a combination? Are you light, yellow, olive, dark, or black? What works for oily skin won’t work for dry or combination skin. And what works for Asian skin is unlikely to work the same way for Caucasian or White skin.

- Vitamin C serum: Apply this in the morning after washing your face but before moisturizing and sunscreen. I’ve tried many vitamin C serums, but my all-time favorite is the one by Mad Hippie. A really good and budget-friendly one is OZNaturals, which I also like a lot!

- Tranexamic Acid mixed with Niacinamide serum: After 10 to 20 minutes of applying vitamin C, you may also want to try a product with 5% tranexamic acid mixed with 5% niacinamide serum like the Cos De BAHA serum to help brighten the skin and reduce hyperpigmentation. Another milder form you can try is the Discoloration Correcting serum from Good Molecules.

- Vitamin A products: This includes products like retinol (OTC) or tretinoin (prescribed), which is advised by dermatologists to be applied during nighttime after cleansing your face with a gentle cleanser. But make sure to protect yourself with a “broad-spectrum” sunscreen the next morning because these products are sensitive to the sun. A budget-friendly and effective one for beginners is the Retinol 0.5% (or 0.2%) in Squalane by The Ordinary.

- Avoid products with long ingredient lists because over 90% of them are filled with chemicals and toxins that may be harming and aging your skin despite the product’s claim to make it youthful.

- Experiment with 100% natural oils: Natural oils that are cold-pressed and unrefined are not only cheap and budget-friendly compared to the marketing hype of expensive products, but they are truly beneficial for the skin! Depending on your skin type, you can find one that best suits you. That may include squalane (perfect for all skin types), vitamin E, argan, rosehip, and jojoba – those are my personal favorites and I alternate between them, but there are so many more! My favorite budget-friendly oils are:

- 100% Plant-Derived Squalane by The Ordinary

- Cliganic 100% Pure Vitamin E Oil

- Cliganic USDA Organic Argan Oil

- Cliganic Organic Rosehip Oil

- Cliganic Organic Jojoba Oil

- Coconut oil: Coconut oil is great for the hands, arms, and legs. But you may want to avoid coconut oil on the face because it could clog your pores. I personally only use coconut oil as a pre-cleanser (before cleansing my face) to remove makeup and sunscreen in the evening. My favorite budget-friendly coconut oil is the Cold Pressed Organic Virgin Coconut Oil by California Gold Nutrition

7. I quit buying unhealthy foods

Yeah, you may be rolling your eyes and thinking this point sounds cliché but what I realized is that many of us are unaware that we are eating unhealthily and wasting money on junk (even many of those who think they are “health conscious”) – that was me too!

I used to mindlessly spend money on snacks that were labeled as “healthy” due to the company’s smart marketing ploys. I had no idea that those ingredients are harmful and would have an adverse effect on my body. That includes those tasty 72% dark chocolate-covered nuts loaded with hidden sugars or heavily added sugars in those trail mixes that are disguised as healthy.

Once I realized this, I stopped buying unhealthy foods and snacks altogether (including typical junk foods like chips, cookies, salted and roasted nuts, sugary baked goods, etc.) and started investing my money into only whole foods that actually nourish my body.

Affordable and worthy whole foods include things like bananas, berries, apples, carrots, hummus, sweet potatoes, avocados, unsalted and seeds nuts in their raw form and other fruits and vegetables that are filled with essential vitamins and antioxidants.

I also learned how to truly make healthy baked goods (not FAKE healthy foods) that are actually good for you, which allows you to control what ingredients you put in them. Not only does this turn out to be A LOT cheaper than your typical store-bought, but also healthier for you. At the end of the day, health is wealth!

8. Prepacked and ready-to-go meals

You have to admit that grab-and-go cheap pizzas from the grocery store are cheap compared to your regular pizza joints.

That ready-to-go quinoa salad mix or pre-made lasagna from Costco seems pretty tempting.

And those frozen meals from your grocery store aisle (even the ones marketed as “healthy”) are still really harmful.

Yeah, they’re quick and convenient, alright!

They may also not be as expensive as takeout or dining out. But they are still considered more expensive than cooking your own meals at home, and just as unhealthy as any other normal takeout or dine-in meal at the restaurant (despite them being marketed as healthier alternatives)!

As a result, I learned how to meal prep for 5 days a week and created a system where I don’t need to invest much time into preparing or cooking.

This has not only saved me thousands of dollars over the years, but it has also saved me from paying visits to my doctor! As you may know, those doctors’ visits and medical bills end up costing way more in the long run and degrading the quality of your life!

9. I stopped buying too many clothes and created a capsule wardrobe

One day, skinny jeans are all the hype, and the next, everyone’s raving about loose-fitting trousers. Fashion trends shift with the speed of lightning, and most of the time, we feel like we have to keep up.

I’m guilty of it, too! I was a big sucker for buying so many clothes because I wanted to be in the crowd. I didn’t want to wear something that wasn’t trendy or new. To rub salt in the wound, it’s even harder to resist the temptation when there are sales left and right. I thought I was saving money, but I was actually spending more.

Luckily, I got out of the daze. I realized that I wasn’t even wearing half of the clothes I bought. Even though I had so many clothes, I felt like I didn’t have anything to wear. I would just keep reaching for the same 5 pieces that I was comfortable in.

That’s when it hit me: there’s a solution to all my clothing problems. A capsule wardrobe.

You don’t need more clothes. All you really need is around 40 (or less) high-quality pieces that you can mix and match. Try to look around your closet and see what pieces you would normally wear. It’s always the neutrals, right? Well, they’re the key to creating your capsule wardrobe.

I suggest having more clothes with neutral colors and simple silhouettes. They’re the easiest to style and pair with another piece. Classic white button-downs, black trousers, and a simple black dress are essentials that you should have.

It’s also best to invest in your clothes, which means that you should have high-quality pieces that can last a long time. Sure, they might be on the pricier side, but it’s all worth it in the long run. Better to have a piece that you can wear for years instead of having to buy clothes every month.

10. Impulse buys at the grocery store (this is more than you think).

We all know how expensive it can be to always order takeout or dine out at restaurants. When tummies have been filled and the bills have been paid, it’s like watching your hard-earned money evaporate into thin air.

That’s exactly why when we stopped spending our money on unnecessary things and reduced takeout expenses, we made more trips to the grocery store. Cooking at home is the way to go if you want to cut down on your food costs, right? Well, that wasn’t the case for us at first.

My husband is the one who loves to go grocery shopping, but on most days, he would just walk aimlessly with no clear plan. Let’s just say he was deciding based on impulse and the vibes he was feeling that day. Bad move!

We only started to see the problem after so much food went to waste because we weren’t able to use them by their expiration date. We also realized that we weren’t saving any more than we did when we ate out.

So, what we did was sit down and make a meal plan for the week. We wrote down all the items we would actually consume and need in this cute printable I made. After that, it felt like we were new people! No more impulse buys. We were saving money on our groceries, for real. On top of that, we were starting to enjoy our meals, which were healthier and more satisfying.

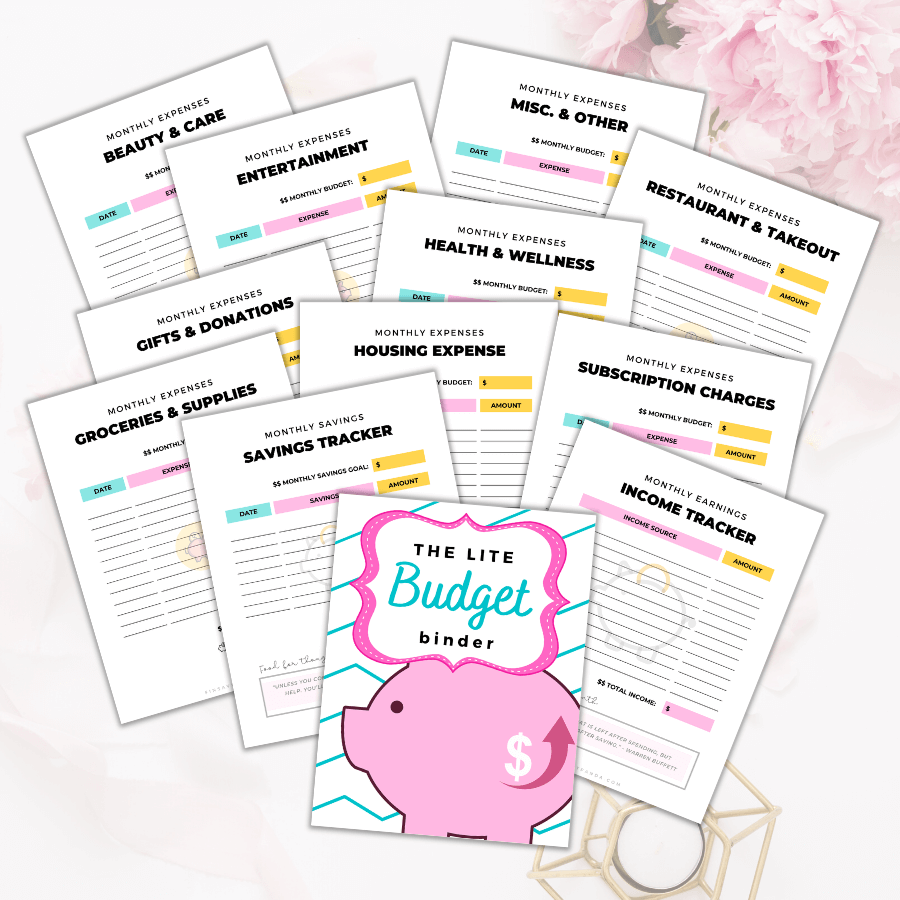

💵 Need help with budgeting and mastering your money?

Download our fail-proof budget printables that can help you save money like a pro!

My fiance and I were inspired by Gail Vaz-Oxlade’s money makeover shows and that’s how we learned about her clever budget strategy.

Having that said, we followed her budgeting strategy and that’s how we were able to build wealth over time.

To help you master your savings, we created our version of her fail-proof budget plan just for you!

In this budget kit, we included a monthly budget tool that keeps track of all your income sources plus expenses. We also made these pretty weekly printables that will keep your budget and savings on track.

These free printables were made to give you instant results to boost your confidence in your financial journey.

This budget kit is only exclusive to my subscribers so you can grab your FREE copy here!

Read also: How To Save $1,000,000 in 10 Years (Without Winning The Lottery)

11. Magazine subscriptions.

I went through a phase where I was obsessed with home décor so I signed up for magazine subscriptions to get inspiring ideas.

And this is what I realized…

There wasn’t a lot of great content in those magazines.

They didn’t offer solutions for decorating my home on a budget. Instead, they were only filled with gorgeous pictures (or should I call them ads) to lure me into buying their really pretty furniture products. I honestly go crazy over stuff like that… 😱

Well, instead of buying brand new solid wood furniture like that, I soon learned that I could flip my own to either save money or make extra money like the image of my work I show below!

Not only was I wasting money on magazine subscriptions, but I was also wasting money on home décor products that I didn’t need.

To think of it, I was paying to look at ads, which encouraged me to spend even more!

To fix this problem, I discovered Pinterest and Home/DIY Bloggers that provided budget-friendly solutions to help me save money! Gosh, why didn’t I think of that sooner?

12. Knick-knacks/doodads (the compounding power of $1 saved). 💵 🔜 💰💰💰

It’s those “cute” random objects (ornaments, toys, notepads, or things with a cute character… Hello Kitty, anyone?) that stop us from saving money!

If you’ve been in the Forever 21 checkout aisle, you’ll know exactly what I mean! I know that they’re irresistibly cute, but let me tell you something…

Being broke ain’t cute, girl!

When I went through a de-cluttering phase, I was surprised at how much money I wasted!

Again, a few dollars here and there add up to a bunch of crap that doesn’t add any value to your life!

I could’ve saved for an emergency fund, a nice vacation, something I truly appreciate and love, or a contribution to my investment account.

💰 PRO TIP: Treat every dollar you save and invest as a “worker” that can grow into more dollars (i.e. more workers). The trick is to have more of your “money work for you” so you can watch your savings grow without having to lift a finger. That’s the power of saving money with compound interest and it’s how people become a millionaire from nothing.

Going forward, when you’re about to buy a knick-knack that costs $5 to $10, ask yourself whether you’re willing to give up 5 to 10 “workers” who could potentially create more workers for you.

This process compounds into something BIG and could leave you with a ton of money saved (without you even realizing it)!

My fiance and I have been slowly saving and investing our money for years. As a result, our investments grew exponentially to more than what we could have imagined!

Readers, before you buy anything, do yourself a favor and ask: “Does this add any value to my life?”

If not, don’t buy it and you’ll save a ton of money!

Remember, each dollar you save and invest is a “worker” you keep. That “worker” can magically make money for you. 🙂

Over to you: What about you? What things did you stop buying to save money? To add more money to your bank account, don’t forget to check out the best places to get FREE cash below!

Here’s my #1 tip to stop buying and save more money!

Up to this point, you’ve read about the things I’ve stopped buying to save money. I have to admit that saving money can feel a bit restrictive at times especially when you have a low income (trust me, I know how this feels!). But life doesn’t have to be that way if you’re willing to put in a bit of effort to make extra money. That’s exactly what I’ve been doing and I would love to help you!

There’s a limit to how much you can save, but there’s no limit to how much you can make.

To give you some money making ideas (so that you could save more money comfortably), I wrote these posts to help you reach your fullest earning potential — most of them require little to no experience. I sincerely hope these articles help! Dive in!

- Save More Money

- Make More Money

- Make Money Blogging as a Beginner (With No Tech and No Writing Experience)

Enjoyed this post? Don’t forget to pin it and follow me on Pinterest! 🙂

We have fine a lot of that for awhile. I have found that doing my grocery shopping online with curbside pick up actually saves you not just time, but money. You don’t see all those “cute” items, delicious looking things you need to try that usually go uneaten and every other thing we “need”. One tip regarding sunscreen that my dermatologist told me, your sunscreen needs to contain at least 9% zinc to adequately block the harmful cancer causing rays. I always thought it was the SPF number, but it’s the zinc.

i do way better. library books, three outfits i can wear outside the apartment, two meals a day, walking 300 miles a year, making incontinence briefs last a weekl

I think we should definitely try and save some money because of the cost of living. I am thinking of doing a clothes and junk sell out. Because I love buying clothes I’ll try and get most of Vinted for less money.

@Shouldi – Yes, I love the idea of selling your old clothes online! Thank you for sharing your insights! 🙂

Brilliant! I will try all those things.

Thanks Ling for your tips to avoid unnecessary spending. I am following you to get more quality content like this post. 👏👏❤️

@Yugal – I’m so glad to hear this! I am excited to have you follow along!:)

This article provides valuable insights on how to stop buying unnecessary items and save money without sacrificing the things we enjoy. It’s a refreshing perspective that encourages mindful spending and finding fulfillment in what we have, ultimately leading to financial success. The practical advice and relatable anecdotes make this article a must-read for anyone looking to improve their finances and live a more fulfilling life.