We will receive a commission if you make a purchase through our affiliate link at no extra cost to you. Please read our disclosure policy for more information.

Learn how to better manage your money with this simple guide on how to make a monthly budget. Creating an effective and simple budget plan worksheet allows you to take control of your finances today.

Budgets are not sexy but most people admit it’s essential to have a personal budget if you want to manage your money better.

NerdWallet reports in 2023 that 74% of Americans have a family budget and almost all Americans believe that everyone needs a budget. Despite this high number, it is reported that many still overspend.

Creating your own budget should be painless and not nerve-racking like the last interview you had.

If your budget is overly complicated, it’s guaranteed to fail.

Before you master your budget plan, I recommend adding this helpful article to your reading list: Which payment type can help you stick to a budget?

On top of that, I have a little surprise for you! For a limited time, you can steal these beautiful templates from my budget binder for FREE! They will help you track your income, ALL your expenses in organized categories, and put your savings where you want!

You can also learn more about my free budget template worksheets here. These sheets have helped me get into the groove of saving money and building good long-term habits for over a decade.

How to create a budget plan

Avoid bad budgets that are restrictive and make you feel guilty for spending. These kinds of budgets are ineffective and often lead to budget burnout.

Your personal budget should be flexible and fit your frantic lifestyle. When creating a budget plan, remember that a budget is designed to serve you, not the other way around.

For example, I also have an adult piggy bank on my desk for fun to keep my loose change at the end of the day. This really helps me save extra money without feeling like I’m saving money. How awesome is that?

Whether you prefer to stick to the paper and pen method using a pretty printable budget binder like this, or creating a budget spreadsheet in Excel, making your own budget gives you insights into where your money is going so you can make better financial decisions and reach your financial goals.

Here are 5 simple steps to creating a budget that you can stick to.

Step 1: Set your goals before creating a budget plan

Before you even begin creating your beginner’s budget, you first have to figure out what you want to achieve with it.

“A goal without a plan is just a wish.” – Antoine de Saint-Exuperys

Oftentimes, budgets fail because we don’t know why we’re doing it. We’re just doing it because, well, everyone else is doing it.

If that’s your mindset, I’m begging you to please change it as early as now. It’s not going to get your far because there might come a time when you’ll think “what’s the point?”

For you to succeed, you need to ask yourself: What are my short-term and long-term financial goals? Am I making this budget to pay off my debts and get my life back on track? Am I tired of living paycheck-to-paycheck and want to get out of this deadly cycle?

Your goals don’t have to be big. They can be as simple as saving up for a vacation with your friends or as crucial as building an emergency fund. Regardless of how big or small your goals are, you need to constantly remind yourself of them. Write them down, tell it to someone, or set reminders on your phone.

Why should you go through all the effort to remember your goal? Because if you have a realistic goal, you’ll be more motivated to work towards it. We don’t realize it, but setting a motivation or goal has stronger psychological effects than we think.

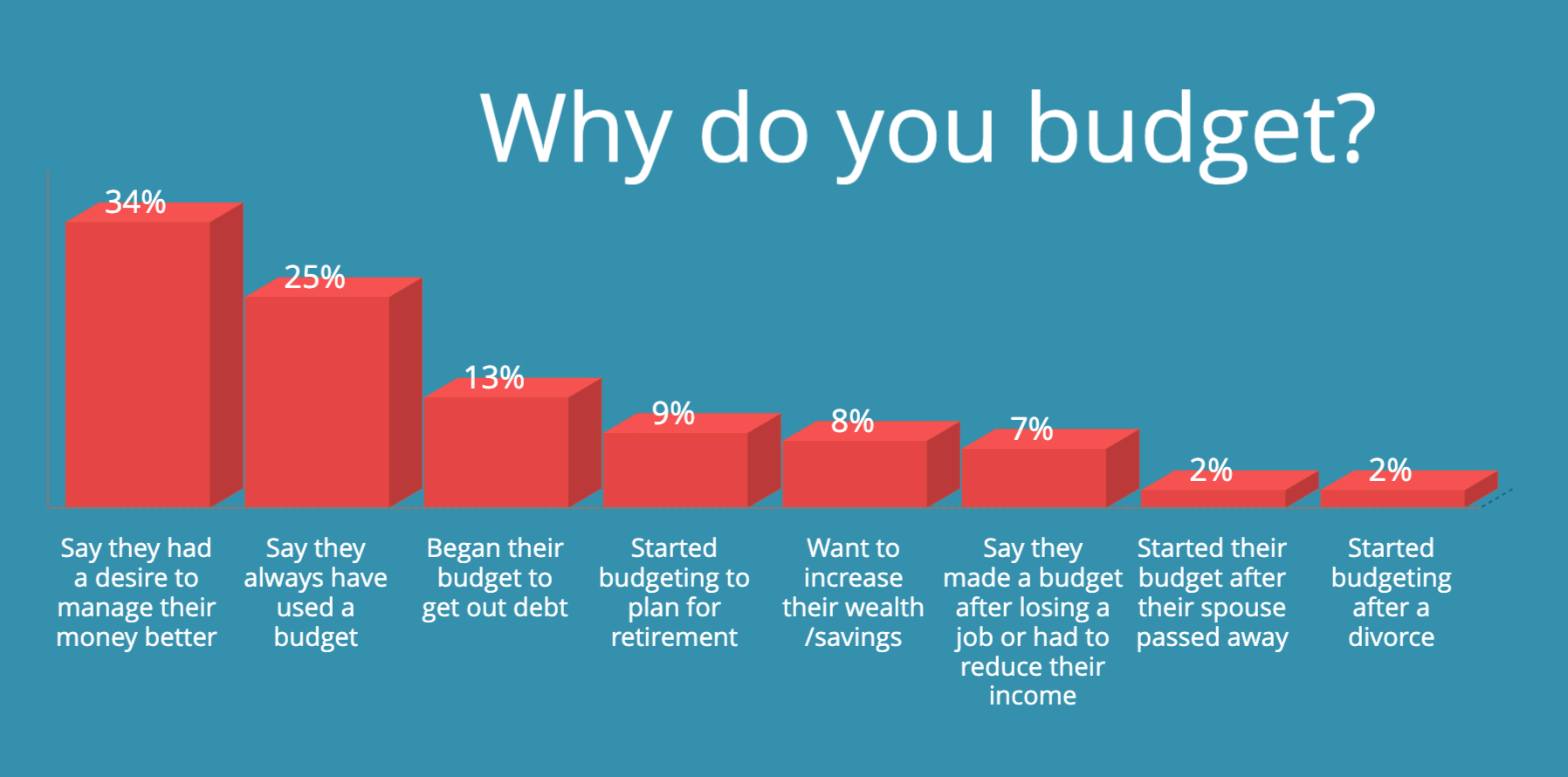

To give you an idea, here are some reasons why people create a budgeting plan:

Source: Debt.com

Step 2: Choose a budget type that fits your personality

When it comes to budgeting, there is no one-size-fits-all that will work for everyone. In fact, there are many types of budgeting systems available to help you achieve your financial goals; each one has a different strategy to get you there.

The key is choosing a budget plan that matches you and your lifestyle.

The Envelope System

The envelope system is a cash-only system and has been around for a long time. It’s simple but powerful.

How this system works is you use hard cash to pay for things (sorry, credit cards are not accepted).

To start, you’ll need to write down your budget categories — groceries, restaurants, entertainment, etc. — onto separate envelopes and stuff them with cash. The amount of cash you put into each envelope is your monthly budget or spending limit for each category.

When you spend, you’ll need to take cash from the envelopes to pay for things.

Once an envelope runs out of cash, that’s it. No more spending in that category for the rest of the month. You’ll need to wait for next month to fill up the envelope with cash and spend again.

The idea behind this system is to get you back in touch with your money. Paying things with your cash hurts a lot more than tapping or swiping with your plastic cards.

The envelope system is old school, but it works.

Perfect for you if you lack the discipline to stick to a budget and want to curb your spending.

The Reverse Budget

This is actually my favorite budgeting method because, in my opinion, it doesn’t feel like I’m budgeting.

Traditional budgeting tells you to save the remainder of your paycheck after paying your living expenses. But for most people, the reality is that after all your bills and expenses are paid, you’re left with nothing.

The reverse budget system turns your finances around by focusing on this concept:

Pay yourself first.

This budgeting method “reverses” the budgeting process by prioritizing savings over expenses.

When you receive your regular paychecks, the first thing you need to do is take care of yourself by saving a portion of that money. After you’ve set aside money to meet your monthly savings goals, you move on to pay your living expenses.

This way, you won’t be the last person in line, thinking there will be money left over for you. That’s wishful thinking.

This type of budget works best for people who find it challenging to save money at the end of the month.

It is also perfect for those who prefer to save first before spending.

As Warren Buffett puts it: “Do not save what is left after spending, but spend what is left after saving.”

The Zero-Based Budget

The principle of the zero-based budget is to put all of your hard-earned money to work. Every single dollar and penny has a purpose — to put food on the table, pay off debt, build an emergency fund, etc.

By following this approach to budgeting, your income (inflows) needs to match your expenses and savings (outflows) by the time you’re done with your budget.

When you assign all your money to a job with a free budget sheet template like this, you’re being intentional with your money. You can direct it to savings or debt repayment as opposed to bucketing that leftover cash into the miscellaneous category.

We all know that miscellaneous spending is just another name for fun money.

With great power comes great responsibility.

The zero-based budget is best suited for people who like to plan ahead, don’t mind tracking their expenses, and want full control of their money.

The 50/30/20 Budget

Budgets that have short lifespans tend to emphasize cutting out or eliminating costs altogether and leave no room for fun. What’s the point of saving money if you don’t get to live a little?

This is where the 50/30/20 budget comes in and saves the day.

The philosophy behind the 50/30/20 budget is balancing your needs, wants, and savings. This allows you to work towards your financial goals without having to unfriend everyone on your friends’ list.

The way it works is very straightforward.

50% of your paycheck is allocated to take care of needs like housing, food, transportation, and health insurance.

30% of your income goes to wants, such as dining out with friends, service subscriptions, and entertainment.

20% of your paycheck is dedicated to savings and paying off debt. This includes building an emergency fund, contributing to your 401(k) plan, and debt repayment.

The 50/30/20 budget is ideal for people who prefer simplicity and a balanced approach to budgeting.

👉 You can learn more about the 50 30 20 budget rule here in greater detail to see if this budgeting method fits your personality and style of budgeting.

How to create a budget plan for beginners with free printables

Are you new to budgeting?

No sweat.

While I was searching for the best frugal living tips to help with my savings goals, I also created a set of budget printable templates that are easy to use.

I would love to share this printable budget binder with you, so you can build a better relationship with your money too!

These are the templates we used to help manage our money and save over six-figures over the years. Download your free budgeting printables here. 🙂

Step 3: Add up your after-tax income

Add up all the money you and your spouse receive from full-time or part-time work, government benefits, side hustles, etc.

Look for your after-tax income, not the gross income.

For those of you who receive steady bi-weekly paychecks, your monthly take-home pay is your after-tax income.

Many employers have 401(k) matching programs where they will match your contribution to your 401(k) account. Make sure you contribute enough to get the full match from your employer. This is one of the easiest ways to get free money and you can’t afford to miss out on it.

When you contribute a portion of your salary, via deductions, to your 401(k) account, count it towards your savings goal.

Now, if your monthly income fluctuates, you can take the average after-tax income of your last 6-12 months as your starting point.

Do you earn extra income on the side by doing freelance work? Include that as part of your total income.

Needless to say, finding ways to make extra money can help tremendously and give you more flexibility with your budget.

⭐ One of my top recommendations and favorite ways to earn extra income is starting a blog.

Just two years ago, I started this blog as a fun hobby while working my everyday 9-5 job.

I was looking for ways to improve my financial situation and starting this blog allowed me to document my financial journey while learning how to earn extra money online. To learn more, you can visit my step-by-step tutorial on how to start a blog for beginners. I went from earning an extra $1,000+ per month to turning it into a full-time income today.

The extra money definitely gave me more flexibility and allowed me to stretch my budget on things that matter to me like vacation and dining out with friends at my favorite restaurants.

Step 4: List all your expenses

Your bank account is the Bermuda Triangle for money. Money that enters it disappears without explanation. It’s one of life’s greatest mysteries.

Well, you’re going to bust this mystery once and for all.

How?

Easy, you’re going to review your past transactions for the previous months to see where your money went.

Simply download your credit card and bank statements for the last 3 months and allocate all your expenses into spending categories: housing, utilities, groceries, transportation, entertainment, and so on. Cash purchases for coffee and snacks are easy to miss so be sure to include these expenses in your budget.

This is the perfect opportunity to bucket your spending between needs, wants, and savings to see how close or far you are from the 50/30/20 budget. It’s also the perfect opportunity to see what unnecessary things you’re spending on.

This step is often a reality check for many people because most of us don’t know exactly how much we spend on necessities, nice-to-haves, and savings – if any.

Don’t make excuses to justify your overspending nor be too harsh yourself. Take a moment to reflect on your spending habits and commit to making changes. This is why you’re making a budget, to improve your financial situation.

Related post on budgeting and expenses: How To Stop Buying Stuff You Don’t Need Online

Step 5: Review and make adjustments

Budgeting isn’t a one-time thing that you just do over and over again. It’s a continuous process that you have to regularly monitor and adjust for it to be effective.

If you create a budget but don’t bother reviewing and adjusting it, you’re missing out on the most crucial aspects of budgeting: accountability and tracking.

A straightforward budget for beginners will be effective if you can review it at least weekly. Depending on your situation and goals, you’ll have to make the necessary adjustments. You will have to do this every week until you get the hang of budgeting. Once you get the hang of it, you can revisit your budget every month and make small changes until it becomes second nature.

The reason why it’s so important to constantly update and adjust is because life is unpredictable. Your financial situation can change in an instant, so you have to be able to adapt to these changes to stay on track toward your goals. After all, you never know when your car might need repairing or when your best friend suddenly wants to get married the next month! If you want to keep both the car and your best friend, you’ll have to be flexible with your budget.

Final thoughts on how to create a budget

They say the first step is the hardest, and I’ll have to agree with that.

Learning how to create a budget is the hardest step to gaining control of your finances, but it’s the step you need to take now.

You need to set a clear boundary between your needs and wants, and adjust your budget accordingly. Remember that you should set your boundaries since what works for others may not work for you. Don’t let others dictate what you should and shouldn’t spend on since your budget is tailored to your circumstances.

At the end of the day, as long as you’re able to save and plan for the future while doing what makes you happy, you’re winning.

I have been running the budget only for 2 years. Let me say one thing, it was difficult for the first year. The second year allowed me to plan my expenses better. I think that the coming years will allow me to generate some surpluses that I will invest.

Hi Chris – that sounds awesome that you have your budget under control! Investing is the best thing you can do with your surplus. Kudos to you!! 🙂

You are perfectly right that it shouldn’t be hard and exhausting otherwise it is bound to fail. To be efficient, budgeting should be transformed into a game or a tool for achieving a specific aim.

Thank you for sharing these tips and promoting the idea of budgeting! In my opinion, everyone needs a budget, because the bigger number of people who will take care of their budgets, the less number of people will be struggling with poverty.

Hi Kathryn – I’m glad you enjoyed this article about creating a budget for beginners. Thank you for sharing your comments! 🙂