We will receive a commission if you make a purchase through our affiliate link at no extra cost to you. Please read our disclosure policy for more information.

We all know that we should be saving money for retirement and unexpected events like that furnace that needs a replacement. But with our daily living expenses (e.g. rent, mortgage, food, entertainment, etc.) and no real budget, it’s hard to save anything!

That’s why the 26-week or 56-week money savings challenges can come in handy when you need cash.

Like you, I’m always unknowingly scratching my head and asking: “Where did all my money go?”

Over the weekend, I read a few articles about the average American savings and it didn’t surprise me that more than half are struggling to save money. According to Forbes, 61% of Americans save little or nothing. When they asked Americans what’s keeping them from saving, the No. 1 answer was “Expenses.”

Does that sound like you?

Yeah?

Well, the good news is that you can learn how to create a proper budget plan today and stop that vicious cycle of living paycheck to paycheck. Even if you’re not living paycheck to paycheck but wondering why your savings aren’t growing fast enough, I’ve got a solution for you!

It all comes down to knowing exactly where your expenses are going. Up until now, there will be no more second guessing or “I think my money was spent on…” type of thoughts!

To help you conquer your finances, I created this awesome weekly budget binder just for you. Yes, yes, yes… it’s FREE! These are the same resources we used to help us get from almost $100,000 in debt to saving over 6 figures and eventually building our first $1,000,000 nest.

PIN (OR BOOKMARK) THIS PAGE: I’ll be updating this post so make sure to pin this image and save it to your Pinterest board. This way, you can return to this page and access the budget printables that helped me save my first $100,000, which played a big role in reaching my 7-figure net worth.

How We Used Our Budget Printables and Save Money and Invest

We both started out with humble goals. By “humble,” I mean saving our first $1,000. I used a piggy bank, while he chose a pasta mason jar. Different methods, but both are effective when you’re taking those initial steps.

As we developed a good habit of saving $1,000 per month and secured our first jobs, we used simple sheets like this free budget template here to give us a clearer view of our individual finances.

We transitioned from piggy bank savings to automating our finances, directing funds straight from our paychecks into bank, retirement, and investment accounts. This shift, coupled with our upgraded premium budget binder, enabled us to save our first six figures, even without a six-figure income. It was a simple tool that helped us save for our first home’s down payment, pay off our car and student loans, and still invest at the same time.

We’re living proof that when you start small, stay consistent, and stick to a simple budget plan, you can reach financial milestones you never thought possible. Naturally, practicing frugal living, asking for a pay raise, taking advantage of your work benefits, and finding ways to earn extra money also makes a significant difference.

My other resources on how to create a budget for beginners:

- Budgeting For Beginners: How To Make A Budget Plan

- What Is The 50/30/20 Budgeting Rule?

- Which Payment Type Can Help You Stick To A Budget?

- Accelerate Your Savings To $100K With The Power-Up Budget Binder

- How To Save $10,000 in a Year For Beginners

My FREE Budget Printables

Now, I’ll be honest. I’m not the type to meticulously follow a budget down to the finest details. Tracking it on a bland, lined piece of paper? Utterly BORING. UGH!

BUT…

It’s an entirely different experience when you have a beautiful budget binder brimming with vibrant and playful printables! Suddenly, budgeting and monitoring your finances becomes a delightful and rewarding activity. My fiancé and I have been using this budget template, and we’ve seen our savings skyrocket by 50%. All because we took the time to jot things down on an appealing piece of paper!

I was inspired to craft my version of the FinSavvy Panda budgeting tools just for you.

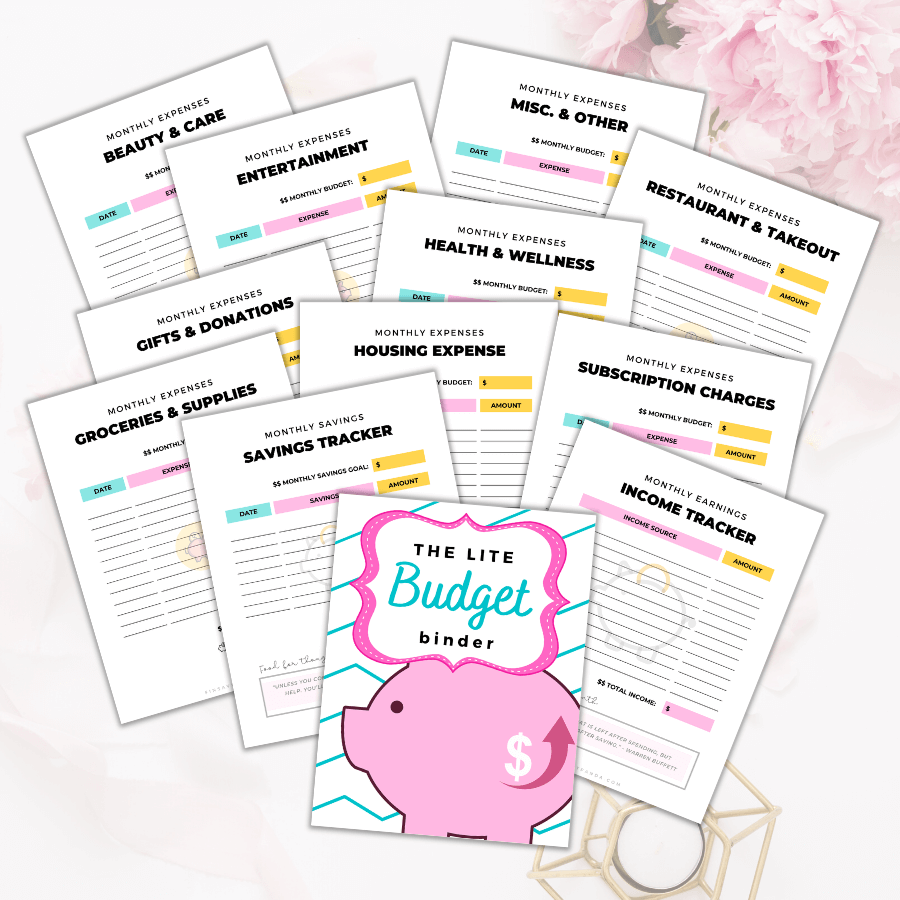

Here are five reasons why my free budget printables (the LITE version) will work wonders for you:

- Organizing your budget will diminish stress and amplify motivation.

- Keeping dated records will show you the frequency of your spending.

- Categorizing and jotting down items will give you a clear picture of where your money goes.

- Documenting your budget and objectives will spur you into action. Research has shown that penning down goals is effective.

- As time passes, you’ll observe that your budget binder narrates a tale about your spending habits. It’s fascinating to witness the gradual shifts.

- And as an added perk, these printables are not only aesthetically pleasing but also fun to use!

Before you know it, you’ll be a financial whiz after using them. 😉

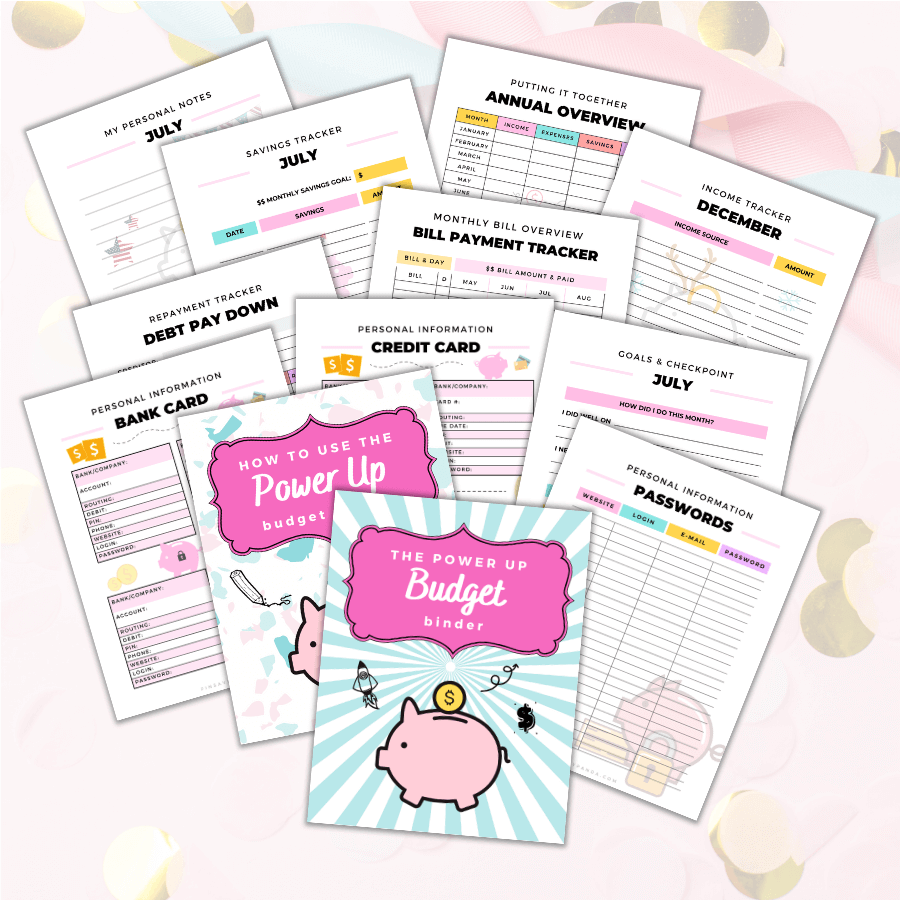

The Power-Up Budget Binder (Premium Monthly Planner)

If you are serious about skyrocketing your savings as we did, then I recommend my best-selling budgeting product — The Power-Up Budget Binder. This is the exact binder that helped us move from $100K in debt to saving over six figures. This ultimately compounded, leading to our first $1,000,000 when we used our savings towards investments to grow our equity.

You can learn more about the premium version of our budgeting binder here.

Related posts on how to manage and budget your money better:

If you follow my blog, you’ll know that I’m a huge fan of saving, budgeting, and earning extra money. I love sharing my financial tips with my readers so they can form a healthy relationship with their money.

Be sure to check out these other blog posts that will help you improve your financial situation!

- How To Stop Living Paycheck To Paycheck

- Sneaky Ways To Get Free Money and Save $5,000

- 60+ Clever Ways To Save Money Every Day

Disclaimer: While I can’t promise success, given that outcomes depend on individual circumstances, I’m sharing strategies that were effective for my family in saving money. I genuinely hope these insights prove beneficial for you too! Thank you for reading!

Enjoyed this post? Don’t forget to share it and follow me on Pinterest! 🙂

Always smart to track progress and write down goals.

I have morphed over the years on how I accomplish this. In the beginning I was using Mint but it actually stressed me out and became unhealthy for me (daily update of accounts and spending),

Success with money has many components. I feel like I have found “success” in no longer being stressed with a budget. We freely spend as long as we hit our savings goals.

This year will put us on track for the best savings year yet!

Great options for those looking to track their progress.

Hey DM!

It’s always nice to hear from you!

You’re right that excessive tracking on Mint can be stressful haha. I like to track once a month, but I did have a period when I was addicted to the numbers.

Also, creating a budget and tracking is very useful for those who have struggle to save and have no clue where to start. That was me once upon a time haha…

As always, you’re doing awesome! Keep it up!

Hey Panda! I downloaded the toolkit – the binder is so pretty! (your natural style!) It’s like a life planner!

Great job in putting together these beautiful docs and workbook!

Hey Mrs. DS!!

I’m glad you like ‘em! I’m planning to make more printables but just not sure what kind yet lol!

As always, I appreciate your comments 🙂

This is so great! Thank you! Your story is so inspiring so this is perfect.

Hi Ashley!

Thanks for dropping by. I’m glad you find this helpful 🙂

This is awesome just like all your posts!

Thanks CJ! 🙂