We will receive a commission if you make a purchase through our affiliate link at no extra cost to you. Please read our disclosure policy for more information.

Are you in debt and struggling to save for your dream vacation?

These are signs that you are living beyond your means.

But don’t worry; you’re not alone.

Many people are dealing with debt and barely have any money in their bank accounts. It’s no surprise that saving money and frugal living blogs are very popular these days. They could help you realistically save $10,000 in a year.

On the other hand, many people have saved their way to a million dollars through frugality as indicated in the book called, “The Millionaire Next Door.”

Whether you’re in search of responsible frugal living suggestions or you’re tempted by extreme penny-pinching methods, I’m here to reassure you that it’s possible to become a millionaire by 30 (even in your 40s, 50s, 60s, and beyond) through solid money habits alone.

Saving money is not easy, but it’s not impossible. You won’t need extreme cheapskate tips like dumpster diving to build a healthy relationship with your finances. There are many simple frugal living tips and ideas that are easy and effective.

Before we jump into the best frugal living tips and ideas that work, we need to clear the air around frugal living.

PIN (OR BOOKMARK) THIS PAGE: I’ll be updating this post so make sure to pin this image HERE and save it to your Pinterest board. That way you’ll be able to come back to this page and learn the best frugal living ideas!

What is frugal living?

There are so many benefits to frugal living but let me walk you through what frugal living really means.

When people hear the term “frugal,” they cringe.

Why?

This is because they believe that living frugally means living a life as a cheapskate. They think that frugality is about not spending, not even a penny, and depriving yourself of happiness.

Being frugal is NOT the same as being cheap, full stop.

So no, I won’t be discussing any extreme cheapskate ideas here, as they can sometimes lead to negative health impacts, poor manners, and dishonest behavior toward others. I’m really not a fan of this, and it makes me feel quite uncomfortable when I see others discussing this topic.

The meaning behind frugal living is to be mindful and smart with your money.

Focusing your spending on things and experiences that ADD value and bring joy to your life, and not wasting money on unnecessary things is the key to frugality.

When shopping, frugal individuals choose quality over the lowest price.

Frugal people are not afraid to pay a premium for a pair of New Balance running shoes than to buy a generic pair of runners because they value comfort and durability. They expect the pair of New Balance will likely have better support for the feet and will last longer than a pair of no-name runners.

A cheap person doesn’t like to spend money and will buy the lowest-priced item. They will sacrifice quality along with their health for a price any day.

They would rather buy the least expensive pair of jeans, which won’t last too long than spend more on a quality pair of jeans that will last longer.

Is it good to be frugal?

Yes! It’s always good to be frugal. As I said earlier, there are many benefits to frugal living. Since you’re living a simpler life, it’s easier to focus on what’s really important to you. You get to spend thoughtfully, which means that every dollar you spend aligns with your priorities.

If you’re living frugally, you will experience less stress, less clutter, and more freedom. You won’t be pressured to keep up with the latest gadgets or trends, nor are you tempted to buy anything unnecessary just to feel like you belong. You will feel more content!

Bear in mind that there is a line between being frugal and being cheap. Just don’t cross that line. Being frugal doesn’t mean that you deprive yourself of happiness. It only means that you make intentional choices that bring more value to your life. You’re not going to sacrifice hours of your life waiting in line at the cheapest gas station just to save a few dollars. You also wouldn’t skip a meal just to save on food. Life’s too short for that!

Best Frugal Living Tips and Ideas

These tips are grouped into categories on how we live our lives.

- Money saving tips on food

- Save money shopping

- Frugal lifestyle hacks

- Fun frugal activities

Frugal living tips on how to save money on food

Most people don’t realize it, but food eats up a big chunk of our monthly budgets. According to statistics, the average American household spends around $9,300 a year on food – that’s a lot of money!

Finding smart ways to save money on groceries and food is a must!

Here are the top frugal tips and ideas to save big on food and groceries.

1. Find ways to get get free Starbucks drinks

We all love a good treat now and then. There’s no need to shy away from your favorite Starbucks latte or frappuccino if it genuinely brings you joy.

Personally, I love to drop by when they’re offering money-saving deals during Starbucks happy hours with their BOGO specials!

It becomes even more delightful when you blend all these frugal money-saving hacks to find ways to get Starbucks drinks for free.

2. Get cashback on your weekly groceries

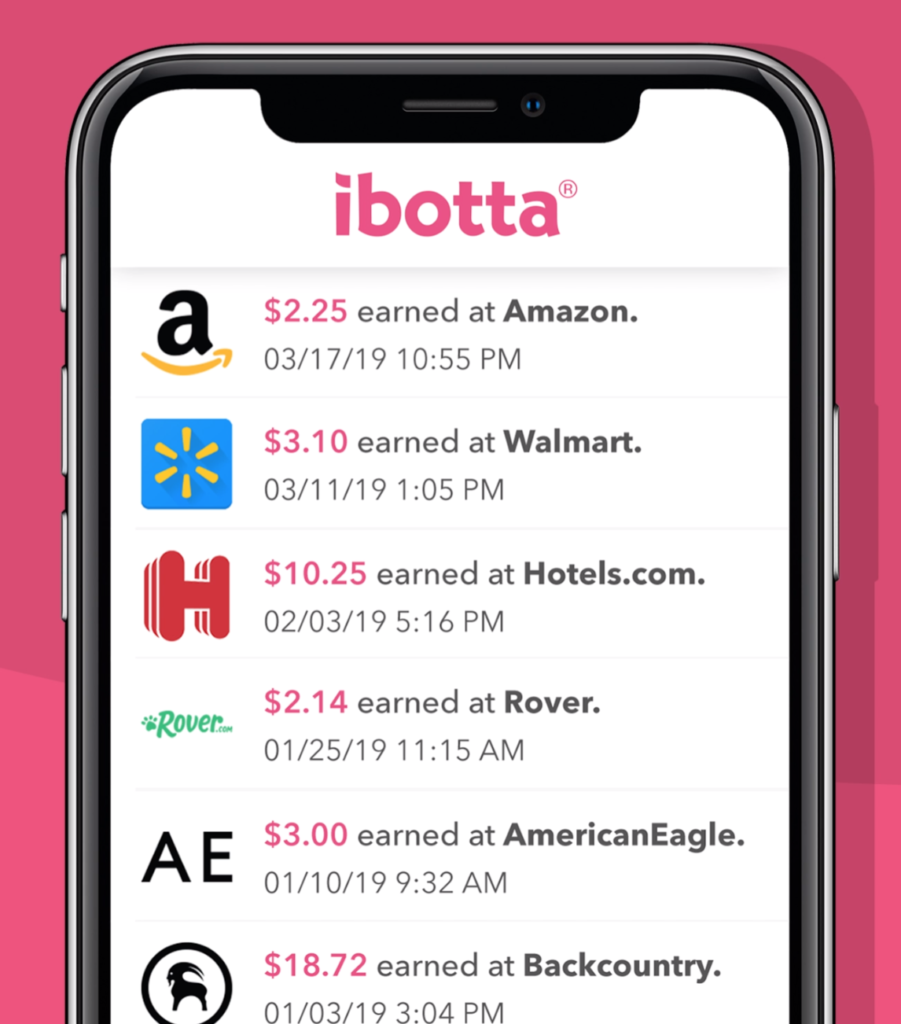

If you love getting cashback on your purchases as much as we do, then you need Ibotta.

What’s Ibotta?

It’s just the best darn app ever!

It’s a FREE rebate app that gives cashback on your groceries (e.g. bread, banana, toiletries). They partnered with major retailers to offer rebates and discounts to everyday shoppers, like us.

It’s quick and simple to earn cashback on your regular weekly grocery shopping; all you have to do is take a photo of the receipt with the app.

Ibotta has paid out over $1.6 billion to its users, so you can trust that this app is legit.

The Ibotta app is so awesome that they are giving away $10 HERE for free to people for trying the app!

Offers like this don’t last forever, so you don’t miss out on the opportunity to get some free money!

3. Purchase items that have multipurpose

Many of us are always on the go and don’t have much downtime, let alone cook a healthy meal.

After a long, gruesome day of work, who has the strength to whip up a delicious meal at home?

The sad reality is that we end up ordering food from our go-to food delivery apps, such as Postmates, UberEATS, DoorDash, etc.

Ordering takeout food is easy but it’s definitely not healthy for the wallet and waistline.

You don’t need to be told that you can save a TON of money by skipping takeout food – you already know that. You want to know HOW you can ditch the food delivery apps for good.

Don’t worry, this is why The Instant Pot was created — to make busy people’s lives easier, a lot easier.

It’s no wonder that it’s one of the most popular selling items in Kitchen and Dining!

You can ditch your slow cooker, pressure cooker, rice cooker, and sauté pan because the Instant Pot can do all of that!

You can make healthy meals in less than 30 minutes with the Instant Pot. Do a quick search online and you’ll find endless frugal living recipes that can be easily prepared in under 30 minutes.

When healthy food can be made that fast, you won’t ever have to worry about contacting the police to report a missing delivery guy.

4. Buy groceries that are in season

When it’s winter, we wear more clothes to keep warm. For summer, we wear lighter and looser clothing to stay cool.

It’s clear that we dress according to seasons so why not eat seasonally?

Fruits and vegetables are fresher and cheaper when they are in season because it’s easier for farmers to grow. The more difficult and costly it is to grow food, the more farmers will charge consumers for their produce. The cost is simply passed onto us, the consumers.

Not only is it friendly for your wallet when you eat seasonally, it also tastes better!

Growers have to harvest their crops before they reach their ripest and refrigerate them to keep them from spoiling during shipping.

If you want a sweet deal on watermelons, buy them in the summer!

5. Buy in bulk and freeze extras

Everyone owns a refrigerator but not everyone uses it properly.

Most people use the refrigerator to store unfinished food for a few days to prevent it from spoiling and the freezer is often filled with ice cream or frozen frugal dinners.

When used correctly though, your refrigerator can save you a lot of money!

Before summer comes to an end, it’s always a good idea to stock up on sweet and cheap fruits and vegetables and freeze them for later.

Frozen fruits and vegetables can be stored for a year, so you have plenty of time to enjoy them! They’re perfect for making morning smoothies to kick-start your day!

For meat-lovers, you can do the same for meat.

When there’s a great sale on chicken, beef, or pork, buy in bulk and freeze the rest for next time.

USDA recommends the following when storing raw meat:

| Item | Months |

| Bacon and Sausage | 1 to 2 |

| Casseroles | 2 to 3 |

| Egg whites or egg substitutes | 12 |

| Frozen Dinners and Entrees | 3 to 4 |

| Gravy, meat or poultry | 2 to 3 |

| Ham, Hotdogs and Lunchmeats | 1 to 2 |

| Meat, uncooked roasts | 4 to 12 |

| Meat, uncooked steaks or chops | 4 to 12 |

| Meat, uncooked ground | 3 to 4 |

| Meat, cooked | 2 to 3 |

| Poultry, uncooked whole | 12 |

| Poultry, uncooked parts | 9 |

| Poultry, uncooked giblets | 3 to 4 |

| Poultry, cooked | 4 |

| Soups and Stews | 2 to 3 |

| Wild game, uncooked | 8 to 12 |

Many people have goldfish memory so don’t forget to write the expiration date on Ziploc bags before putting the meat in the freezer. This way, you won’t be throwing out perfectly fine food in the garbage or even worse, eating food past its expiration date.

Frugal living tips to save money shopping

It might be surprising that “shopping” is even in this post. After all, many people think that living frugally means that you can’t go out to shop for things you want. You should just grab the cheapest stuff and call it a day.

But that’s not what frugality is about.

Being frugal doesn’t mean that you have to avoid buying, or you have to settle for the cheapest every single time.

It’s actually the contrary. You can buy things and still be frugal! It just means that you’re getting the best value for your money. After all, you worked hard for it, so you would want to spend it in a way that brings value and happiness to your life, even if it means that you’re going to shop!

6. Receive cashback on your online shopping

Savvy online shoppers have one mission. That mission is to get the best deal online.

They are skilled at finding clever ways to save money when online shopping.

One of their favorite tricks is to use Rakuten (formerly called Ebates) to get cashback on their online purchases. Because I love and use Rakuten all the time, I wrote this Rakuten app review to explain how to use it to get the most money back on your purchases! So, I highly encourage you to check it out!

It’s so easy to get money back with Rakuten that people think it’s too good to be true. But once you understand their business model, it makes a lot of sense.

Rakuten earns a commission from over 2,500 stores when you shop through Rakuten.com. Rather than keeping all the commission themselves, Rakuten shares the commission with you.

The default cashback is 1%, but when they have promos, you can get 12% off your Amazon purchases!

This is how you can start getting cash back after you create a free Rakuten account here (along with a $30 sign-up bonus):

- go to Rakuten.com

- find the store you want to shop at

- click on the “Shop Now” button

- shop like how you normally

Cashback apps like Rakuten: Another cashback app that I enjoy using is Swagbucks app. For over a decade, I’ve used this and similar apps to save money on my shopping, as well as to earn free gift cards online from my favorite places like Starbucks, Amazon, and Sephora. This is a truly frugal method to snag free items, making everyday living feel a bit more affordable.

7. Invest in a capsule wardrobe to save money on clothes

This is one of my favorite and best frugal tips for you!

Investing in a capsule wardrobe is one of my passionate topics because it allows you to build your dream wardrobe with fashionable and high-quality clothes without hurting your wallet. It’s what I’ve been doing for the last several years, which has helped me quit buying unnecessary things to save money. I saved as much as $300 to $500 a month because I stopped mindlessly spending!

This practice essentially revolves around owning a minimal amount of clothing, but ensuring each piece is versatile, timeless, and interchangeable, thus maximizing the number of outfit combinations.

Instead of impulsively buying seasonal trends, you focus on essential pieces that never go out of style.

A capsule wardrobe can consist of roughly 30 to 40 items, including shoes and accessories, that can be mixed and matched to create outfits for all occasions.

By choosing high-quality garments, you also ensure longevity, which results in less need for replacements. Of course, you may want to replace a pair of jeans in a few years if a certain cut is out of style. Think about the transition from skinny jeans to wide-leg and cargo pants. But with well-cut t-shirts or cute crop tops in all your favorite neutral colors still being classics, there may be no need to replace them unless they decide long shirts become the next trend.

It’s an initial investment, but in the long run, it saves you money, time deciding what to wear, and even space in your closet. It also encourages mindful consumerism and a more sustainable lifestyle, as you’re less likely to contribute to fast fashion. Embrace the capsule wardrobe, and redefine what it means to dress stylishly on a budget! Now that’s how to enjoy frugal living without being cheap!

8. Invest in a frugal and natural skin care regime

It’s not only personal finance and capsule wardrobes that I’m passionate about. I’m all about investing in my skin care. After all, it’s our health and confidence we’re talking about here.

Many people tend to neglect their skin care because their first thought about it is that there’s a lot you need, so it will get expensive.

There’s something you should know, though. Investing in a skincare regimen doesn’t have to break the bank! In fact, you might find that your skin reacts better to more budget-friendly and natural products!

It’s also possible to downsize your skin care to only the most important items like your cleanser, Vitamin C serum, retinol, and moisturizer.

If you can, why not try making your own skincare? Yes! You can DIY it! This can be a game-changer when it comes to saving money and embracing natural ingredients. Raid your pantry and craft up simple yet effective masks and moisturizers for yourself. Your everyday ingredients, like yogurt, honey, and coconut oil, can work wonders for your skin.

But a big part of skincare is keeping a healthy and well-balanced diet. Regardless of how expensive the products you use on your face are, if you’re not taking care of your body inside out, nothing will happen. To be truly frugal with your skincare, you have to eat healthy! Go for skin-nourishing foods like avocado, berries, tomatoes, nuts, and seeds packed with vitamins and antioxidants. This is the only way for your skincare routine to be effective.

Skincare isn’t just about what you put on your face—it’s also about what you put into your body. So eat well, stay hydrated, and invest in your wellbeing!

9. Plan ahead to get great deals

Special occasions can be pretty stressful.

Choosing gifts can be challenging, hence leading you to hastily purchase convenient, yet pricier options when the need arises. It’s a common scenario, but something that can be avoided if you take some time to plan ahead.

For example, instead of doing your Christmas shopping at the last minute, you can start before the -ber months come in. Not only are you saving money (since prices hike up closer to the holidays), but you’re also allowing yourself to be free from unnecessary stress.

Planning ahead means that you create a list of gift ideas so you won’t have to rack your brains for inspiration when the occasion is near. Once you have a list, keep an eye out for sales and discounts, and purchase the items gradually. This way, you’ll spread out the financial burden.

Want to grab your daily dose of caffeine? Well, instead of heading to your favorite coffee shop every morning, you can put aside a few minutes of your time to find some Starbucks deals to save money on your coffee fix. You can save as much as 100%!

Planning ahead won’t take a great chunk of your time. Dedicating some time can make a significant difference in your stress levels and finances. You’ll also have that assurance that you’ve already prepared for what’s coming!

10. Clear your cookies to get the best price

We have to admit that online shopping is already a big part of our lives. But as convenient as it is, it bites off a big chunk of our budgets if we’re not careful.

Did you know that when you go online, even simple tasks like reading the news or watching videos can leave a trail of your habits? Your digital footprint can be tracked by your Internet browser in the form of “cookies.”

Although we can take advantage of them, those sneaky cookies can actually lead us to higher prices!

Sure, cookies make our online lives easier since they remember everything that our minds can’t, like our passwords and usernames. But some retailers use them to charge higher prices to some customers. It’s like they’re playing a game with us, hoping we won’t notice the extra zeros at checkout.

For example, if your shopping habits show that you’ve been consistently buying from one shop, they know that whatever product it is, you’re more likely to buy regardless of the price. So, they charge you a little more.

Some would even reduce discounts if they know you’re always buying from them.

To ensure that you’re always getting the best deal, you should take the time to clear your browser’s cookies before buying online. You’ll usually find the option to clear them under the Settings tab of your browser.

When you clear your cookies, it’s like you put on an invisibility cloak. Retailers won’t recognize you, so they’ll charge you normally as they do with new customers.

If you want to make the most of your online shopping experience, you can even go as far as looking for ways to get paid to shop! You don’t just save money, but you can also make money!

Frugal lifestyle hacks

11. Find free money today

Frugal individuals love to find creative ways to stretch their dollars and make the most of their income. This often includes finding legitimate ways to get free money.

They’re experts at leveraging cashback apps like Rakuten, rewards programs, and credit card points.

By using these tools strategically, they essentially earn money for purchases they’d make anyway. This is an aspect of frugal living that might seem unconventional, but it is incredibly effective.

They also take advantage of things like employer-matched retirement contributions and online surveys that pay. Such tactics might require a bit of effort and planning, but they can add a surprising boost to your savings over time.

12. Find free stuff online

Frugal living doesn’t just stop at saving cash; it’s also about making the most of the resources available at no cost.

A common practice among frugal folks is seeking out free stuff online.

I’ve personally done this before when I was looking for free furniture online to flip for extra money, which helped me make $1,000 fast.

From websites that offer free samples of products, to online communities that facilitate the giving and receiving of used items, there’s a surprising amount of stuff you can get without spending a penny.

E-books, educational courses, software, and even furniture are often up for grabs if you know where to look. It’s like an online treasure hunt, and it’s all about reducing waste, recycling, and saving money. This not only benefits your pocket but also contributes to a more sustainable world.

13. Drink more water

Ever since I turned 19 and had a real struggle with acne, I’ve made drinking water a daily habit. I wanted to avoid sugary drinks that could make my skin problems even worse. Not to mention, did you also know that sugar is the fastest way to age your skin?

Drinking more water is not only a great health habit that gives you glowing skin, but it’s also a fantastic way to save money. Just think about how much you spend on soda, coffee, or juice every day.

If you switch some of those for water, you’ll definitely notice the savings. Plus, staying well-hydrated can help keep your body hydrated, and it might even help you snack less on junk foods, so it’s a win-win for your health and your wallet.

So, try carrying a refillable water bottle around. It’s an easy, cheap way to stay hydrated and cut down on costs.

14. Declutter your life

Take a quick moment and look around your living space.

Is it a mess again even when you cleaned it not too long ago?

Sure, it’s an organized mess and you know exactly where everything is located.

But when you’re in a rush to head out the door, your photographic memory conveniently poops out on you and you’re searching for your headphones like a manic.

Clutter tends to ruin people’s lives and puts unnecessary stress on your health – mentally and physically, relationships, and finances!

When our homes are not organized, it’s easy to misplace items and cause us to buy the same items again. What’s worse is that we may even miss the payment dates on our bills and have to pay late fees because we mixed the bills with the junk mail.

That’s money down the drain!

You can turn your life around and make extra money by selling your clutter online.

Try using the best apps to sell your stuff online for cash. One man’s trash is another man’s treasure!

The takeaway from this is you don’t need to adopt a minimalist lifestyle and live on nothing to reap the benefits of living a clutter-free life.

Keep things that you need, use, and are important to you and your life will be a lot simpler.

Try it – you have everything to gain and nothing to lose.

15. DIY Repairs

Car maintenance is critical to driving safety, but the cost can quickly add up if you bring your car to the dealership or garage for everything.

You can save time and money from visiting the garage by doing simple tasks yourself, such as changing a headlight bulb or changing the oil.

There are many videos on YouTube where you can follow their detailed step-by-step process. If you’re not handy, call a friend up and tackle it as a team.

For complicated or big jobs, make sure you hire a professional to take care of the jobs. The last thing you want is to poke around and make matters worse.

16. Don’t over-wash your clothes

Growing up as kids, we were taught to wash our clothes after every wear to be clean and presentable.

Our shirts are natural ketchup magnets because no matter how hard we try to avoid ketchup, they always end up staining our shirts.

This advice made sense because our clothes get dirty easily when we’re outdoors having fun and living life to its fullest.

As we get older, we tend to be more careful with our clothes and stain them less often – except for coffee stains.

Certain clothes don’t need to be washed after every wear, which we will go over shortly.

If your favorite pair of jeans is still clean (i.e. no stains or odor) after a single wear, you can wear them a couple more times before tossing them in the washing machine.

Skipping the weekly wash cycle will extend the life of your outfits and lower your laundry cost. A win-win situation!

Real Simple’s guide to laundry tips will save you time and money.

- T-shirts and tanks – after every wear

- Anything white or silk – after every wear

- Underwear and socks – after every wear

- Workout clothes – after every wear

- Shorts – after 2 to 3 wears

- Sweaters (cotton, silk & cashmere) – after 2 wears

- Sweaters (wool and synthetic blends) – after 5 wears

- Pajamas – after 3 to 4 wears

- Jeans – after 4 to 5 wears

- Dress pants and skirts – after 5 to 7 wears

17. Always negotiate for more

If there’s one thing we need to improve on, it’s our negotiating skills.

Many of us settle for what we have to avoid negotiating for better salary, hours, and prices because the negotiation process makes us uncomfortable.

One of the main reasons why we don’t negotiate is the fear of rejection and being viewed as pushy or greedy.

If you don’t ask, the answer will always be “no.” But if you ask, you may get a “yes.”

Earning more money is not everything, but it can definitely help many of us improve our living standards. So no, asking for more money is not being greedy.

You need to get out of this psychological trap or else you’ll be leaving money on the table.

Missing out on this money will hurt you financially in the long run. When companies calculate your bonus and salary/wage increases, it’s typically based on your base salary. If you don’t fight for a higher base salary, your raises and bonuses will be lower.

You can also save a lot of money by negotiating better prices for your monthly services.

Call your insurance company, cellphone, and cable service providers to ask for discounts. But before you pick up the phone, take a moment to research what the current promotions are so you have better odds of getting a good deal. Being knowledgeable helps a lot in the negotiation game.

18. Furnish your home on a budget

HGTV makes everyone want fancy homes with all the expensive stuff.

But hey, who says you can’t make your home look amazing without spending a ton?

There are lots of ways to make your place look cool without emptying your bank account. Think about buying used stuff, giving your old furniture a makeover, or using some cool Ikea hacks.

Also, Pinterest is a place to be because it’s packed with affordable ideas!

Fun frugal activities

Embracing a frugal lifestyle doesn’t mean you cut fun out of your life. Sometimes, you don’t need to spend a fortune to have a great time.

What matters most is who we’re spending time with.

Here are some budget-friendly fun frugal activities that you can try with your friends and family.

19. Enjoy the outdoors

In today’s modern society, many of us feel sluggish and tired because we spend the majority of our waking hours indoors and in front of screens.

During work hours, we’re busy typing away at our desks, answering endless emails. At home, we relax on our comfy couch with our smartphones to check our social media feeds and catch up on things we’ve missed.

We spend countless hours indoors and not enough time outdoors.

We don’t need scientific research to tell us that outdoor activities provide many health benefits and can improve our overall well-being.

Go outside and enjoy some fresh air with these fun frugal activities that don’t cost you a thing!

- Hiking: One of the best ways to get back in touch with Mother Nature is by hiking. You can disconnect and escape all the negative distractions coming from your electronics to recharge your mind and body. You’ll feel refreshed and full of energy after a good hike. Be sure to wear proper shoes and stay hydrated.

- Have a picnic at the park: If you like to relax and eat at the same time then going for a picnic is perfect for you. Going on a picnic with your friends and family is a great way to spend quality time together. Being around green scenery is therapeutic and will make you feel calmer and less stressed.

- Go to the beach: When you think of summer, you think of beaches. Save the plane ticket to the Caribbean and head over to your local beach! Go for a stroll on the boardwalk, throw a Frisbee with your friends, or bake in the sun! Again, stay safe in the sun with sunscreen, and remember to stay hydrated.

- Visit local festivities: You are dead wrong if you think that your city is boring and there is nothing to do. There are a ton of things happening in your city, but you tune it out because it’s outside your comfort zone. Open your mind to trying new things and you’ll notice there are many things and activities to do in your own city. If your city were truly boring, there wouldn’t be any tourists visiting it.

20. Visit the library

This is a classic frugal activity that doesn’t cost a cent.

The library is not just for bookworms, although it’s the best place to be if you love reading. This place is a treasure chest filled with free resources for you to discover.

You can read your favorite magazines there without having to pay for those costly subscriptions!

Many people have learned a new language on their bucket list. This is the perfect opportunity to check out some language books and cross it off that list.

If you prefer to kick up your heels and relax in the comfort of your home, you can take a bunch of classic and current movies to enjoy.

21. Host potlucks

Knowing your favorite restaurants’ menus by heart is a sign that you’re spending a lot of money dining out.

Going out once in a while to unwind and catch up with friends is fine. But if this turns into a habit, you’ll be eating away your fortune in no time.

Rather than eating out every time you and your friends want to hang out, try hosting a potluck with your friends to see who are the best and worst cooks!

A good idea is to discuss what each person will be making and bringing to avoid a table full of mac and cheese. Communication is key.

Potlucks will save you from the overpriced meals, terrible services, and mandatory tip culture at restaurants.

22. Games Night

Having a board and card games night with your friends and family is a fantastic way to laugh and humiliate each other. But be careful, if you win every game, people might accuse you of cheating. Haters gonna hate. Players gonna play.

A very fun and popular card game is Exploding Kittens. Trust me, this is super cute and fun! 😉

Don’t let the name fool you; it’s not violent at all. It’s an easy, fun, and highly strategic card game for everyone to enjoy. The Russian roulette-style gameplay makes things extremely unpredictable!

Pick up your favorite games and bring your A-game to the showdown. Here are some more ideas for fun and frugal activities.

How can I live more frugally?

Have you stared at your bank account balance before and wondered why it’s not growing even though your wage increased over the years?

You, my friend, have fallen victim to lifestyle creep.

Lifestyle creep happens when your expenses rise along with your salary.

After making more money, you’ve naturally upgraded your lifestyle by being more free with your money. You started to dine out more often or spend more money at your favorite shops. The nice-to-have slowly turned into necessities.

Luckily, living frugally can reverse this trend and allow you to take control of your finances.

Being frugal doesn’t mean you can’t treat yourself to something nice after a pay raise or promotion. You worked hard for it, so it makes perfect sense to celebrate it!

However, don’t splurge on things that will make you happy for a week only, like upgrading your smartphone to the newest model when your current one works perfectly fine.

Instead, spend with intent – buy things that really matter to you!

Go ahead and book that long-overdue trip you had put on hold forever.

If you ask me, a memorable trip beats a shiny new object any day.

Final thoughts on frugal living tips

TLDR.

Adopting a frugal lifestyle doesn’t require you to cut all your spending and live on nothing.

You can live a happier and less stressful life by eliminating unnecessary spending and clutter from your life. Spend intentionally – buy things that you truly value.

Live a happy life while balancing your needs, wants, and spending.

Readers, did you enjoy these frugal living tips? What other frugal living tips do you have that can help others save some serious money?

Enjoyed this post? Don’t forget to pin the image below! Also, don’t forget to follow me on Pinterest over here! 🙂

I have a tip for readers. If you have a kindle or a kindle app on a tablet, there are several book sites like ereader and BookBub that will send you daily ebook deals at free or discounted prices. Many times it will be a start of a series. If I like the book I will put the rest in my Amazon wish list, which I check daily. Many times they will be reduced later or free. If you delay shipping with Amazon you can get digital credit as well, which I use on books in wish list. Also, public libraries have digital books as well. There

Thanks for sharing your saving money tip!

When I shop online I put the items I like in my cart then go thru the cart and remove items I don’t want before buying. Sometimes when I leave items in my cart the store will email me with an additional discount or free shipping.

I got an instant pot for Christmas and it’s soooo convenient to make food! You literally put everything in it and then let it cook for 25 mins. Dinner’s served

Hey DC!

Thanks for your comment and feedback about the instant pot. It is a great product and I love it!

It’s honestly saved me so much money from going out to eat so often. One of the best frugal living advice out there for busy people who just don’t have enough time to cook or prepare meals!

Great tips!

I always call in to negotiate for better prices. My go-to strategy is to threaten them that im taking my business to their competitors. Works like a charm!

Is that being frugal or hustler??? 🙂

Hey John!

That’s one good strategy to have if you’re seriously looking to save money.

I think that’s more of hustling than “being frugal” if you ask me haha! It’s a good thing though. Plus the results end up to being the same — saving money in your pockets! You ended up getting what you want which is to lower your monthly expenses. 🙂

Great job and thanks for stopping by! 🙏

Hey Ling! Thanks for sharing your new post! These are great frugal living tips that anyone can follow. I agree that many peeps aren’t very comfortable when it comes to negotiating their salaries but it goes a long way. I also like the idea of game nights at a friend’s place – we usually enjoy playing chess with our buds. Haven’t heard about exploding kittens but gonna check it out.

Hey Enray!

I glad you enjoyed these frugal living ideas!

Yeah, negotiating is one of those things that can help you earn more and save more. You’d be surprise with how much money you end up keeping.

Ohhh… Chess is a nice game to play with your friends! To be honest I’m not good at that haha…

Try exploding kittens! It’s pretty fun with a group of people. We usually bring out some drinks and snacks too. Definitely beats over spending at the bars and restaurants.

Thanks for dropping by!

Great post Ling, My wife and i usually have protein shakes as a breakfast as we are so busy and we tend to have bags upon bags of frozen fruit in the freezer which we use and is so time saving. Some of it is even from our own garden and not pre packed. Saves time and money. Hows that for frugal.

Hey Lee!

Great frugal living tip!

That’s the same thing we do here too! We started to buy more frozen fruits for morning smoothies to save money because it’s so quick and easy. Plus they taste great! I still need to try adding protein to mine but I keep forgetting!

I can’t see myself buy booster juice or freshly squeezed smoothies from vendors anymore (unless I’m out with my friends or family members who love to spend) haha.

Thank you for dropping by and commenting!

Great post as always! I love the tips most especially finding cheaper activities such as enjoying the outdoors! I walk outdoors for one hour everyday and I get to avoid paying for gym membership and enjoy fresh air. It’s my everyday FREE mental and physical therapy!

I like Ibotta too, that app has so far paid me over $500 in cash backs and bonuses .

Hi Jane!

Yes, there will always be great frugal living alternatives!

I enjoy outdoors too because it makes me less stress. I feel bored when I’m at home unless I’m using my treadmill or doing some indoor exercises. So no gym membership for me.

I’ve also saved a ton of money by avoiding restaurants. I am seriously afraid to look back at how much I spent. 😰

Just like you, I like cahsback apps too to save some money. 🙂

Thank you for dropping by! ❤️