We will receive a commission if you make a purchase through our affiliate link at no extra cost to you. Please read our disclosure policy for more information.

It doesn’t matter if you live to eat or eat to live, the cost of food eats up a big chunk of your monthly budget. Finding ways to save money on your groceries at the grocery store will definitely make a difference and help you save up faster for your dream vacation.

However, saving money on food may not be easy for most people.

I initially wrote a post about the 12 dumb things I stopped buying to save money. I saved as much as $20,000+ within the year from cutting just those expenditures, which doesn’t include my other $10,000 savings on autopilot in a year.

I had a lot of positive feedback and reactions from readers about my point regarding the amount of money I had spent on food. It was crazy because I had NO idea that I was spending THAT much each month on food (including my grocery shopping) on an annual basis until I pulled out my receipts and added up all the numbers.

The most shocking part is I wasn’t even spending extravagantly either. I was just living like any other regular person.

That’s when I decided to share this post about my realistic tips for saving money on groceries.

Whether you’re grocery shopping on a tight budget or simply looking for easy ways to save on food (anywhere from $200 to $500 per month), I have the best grocery shopping tips to help you keep your grocery bills down.

PIN (OR BOOKMARK) THIS PAGE: I’ll be updating this post so make sure to pin this image and save it to your Pinterest board. That way you’ll be able to come back to this page and discover how to save on groceries every month starting this weekend! These are the tricks I use to save $500+ per month!

How to save money on groceries

As I said, food costs can take up a lot of your monthly budget. But finding ways to spend less on groceries can help you save money. This can be useful whether you’re trying to stick to a small budget, or just want to save a bit more each month. I mean, wouldn’t it be nice to save $1,000 in a month? How can people save money on groceries?

Well, I have some great tips for saving money at the grocery store. These can help you save money each week. Then, you can use that money to pay off debt, add to your emergency fund, or save for when you retire. This guide will show you simple ways to save money on groceries, which means you can spend less on food without missing out on what you like to eat.

Not to mention, groceries don’t account for 100% of your food expenses because there are times when you’ll want to treat yourself.

For instance, I enjoy indulging in a complimentary Starbucks birthday drink without spending a penny, thanks to some little-known hacks on how to get free coffee at Starbucks. And yes, these hacks even apply to their specialty drinks too, which are quite expensive! I thought it’s worth mentioning this as we go along since my readers appreciate the importance of treating themselves to small pleasures while also saving money on food.

Anyway, here are my tips on how you can stretch your grocery and food budget each month.

1. Earn free gift cards to your local grocery retailers

Just like you, I love free stuff! Who doesn’t?

From earning free gift cards to getting free stuff online, you can surprisingly stretch every dollar you spend when you take advantage of free things.

Of course, free things don’t come without a little bit of effort. Luckily, that effort doesn’t have to feel painful.

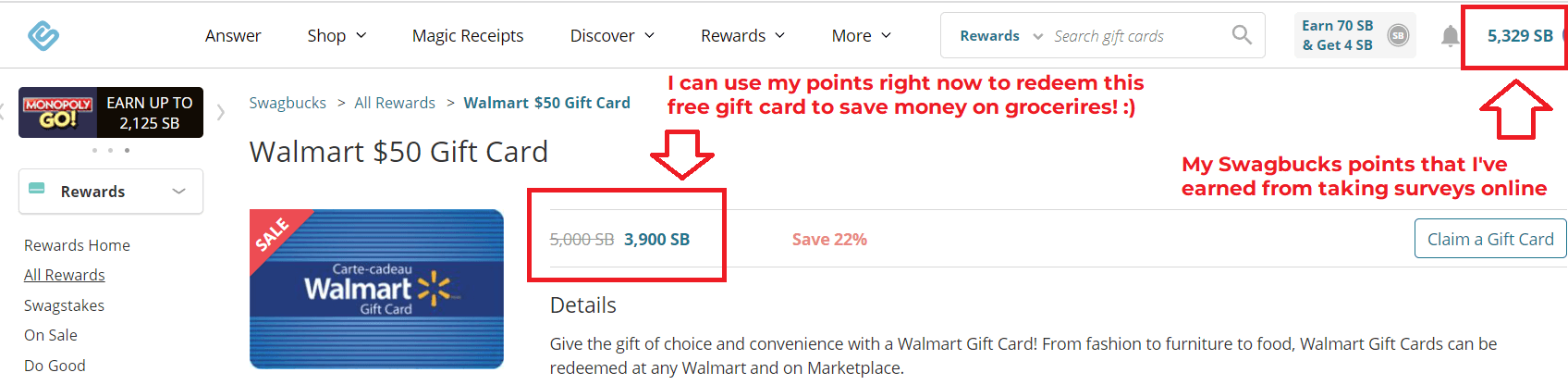

One easy way to earn free gift cards to your favorite local grocery retailer is by using a FREE app called Swagbucks. It’s one of the best survey sites, and one I personally use and love because it allows me to save money on food and groceries.

When you sign up for a free Swagbucks account here, you can start earning points by doing simple activities like taking surveys about your favorite food, beverages, and products, watching videos, or shopping online.

Then, you can redeem these points for gift cards to use on your groceries, which essentially means you are getting a portion of your groceries for free. It is definitely a great way to make the most out of your free time, turning everyday activities into real savings on your grocery bills.

These small things really excite me, and I get all giddy when I get to redeem a free $50 Walmart or Amazon gift card, which I can then use towards my grocery purchases.

Of course, if you don’t like shopping at Walmart, no worries! You can always get an Amazon gift card instead. Amazon still offers fast and free delivery on all the pantry staples like pasta, rice, beans, spices, herbs, and so much more!

And if Amazon isn’t your thing and you’re craving flexibility, you can always opt for the free PayPal gift card option. This lets you use it for your grocery shopping at any store you fancy. Saving money is all about having choices!

I am confident that Swagbucks is 100% legitimate—they have paid out their members over $921,087,343 to date! I’ve been a Swagbucks user for over a decade and I recommend them to anyone who wants to save money on everyday essentials including food and groceries.

You have a lucky start today because you can get a FREE $5 bonus from Swagbucks here just by signing up right now. 😊

⭐️ Important: Make sure you verify the email from Swagbucks in your inbox so you can get your FREE $5 bonus and start earning free gift cards, so you can save money on your groceries today!

2. Create a food budget that works

Learning how to create a budget worksheet for all categories in your life, including food, can become a lifesaver for your finances.

Be honest with yourself. Are you purchasing more groceries than you need?

You won’t be aware if you’re overspending on food, or even entertainment unless you establish a grocery budget to hold yourself accountable.

TAKE ACTION WITH MY BUDGET PLAN: By inspiring my readers to be honest about their financial habits and mindset, I have helped beginners save their first $10,000 to $100,000 with my popular Power-Up Budget Binder. Surprisingly, I personally despise budgeting, which is why I rely on a method called “the reverse budget method.” It gives the feeling of not actually budgeting. The Power-Up Budget Binder provides a precise plan and strategy that my husband and I used to save our first $1,000,000 by the age of 30. We achieved this starting from scratch while also paying off our student and car loans.

Related: How To Build Wealth in Your 20s, 30s, and 40s

It would be disastrous to go on a big trip without planning which places to visit, which restaurants you must try, and which hotel or Airbnb to stay at.

So why be reckless with your hard-earned money by not having a plan on how to spend it?

Think of your grocery budget as your itinerary. It’s a guide on how to spend your money.

Sometimes you spend more; sometimes you spend less than planned. It’s all good; don’t stress too much about it. It’s a “guide.”

Be realistic with yourself when creating your food budget.

Don’t give yourself too much or too little room to spend on groceries. Having too big of a budget makes the budget meaningless and an over-restrictive budget will likely make you quit in days.

Start by looking at how much you spent on food in the last couple of months and use this as your baseline.

As you go through your transaction, you’ll notice things that you can cut back on to save some money.

Again, be real with yourself. Do you really need to treat yourself to that many snacks every week?

Related posts about budgeting your money:

- What is the 50/30/20 budget?

- Which payment type can help you stick with a budget?

- The Power-Up Budget Binder that will boost your savings to $100K!

3. Plan your meals and stick to it

As Benjamin Franklin puts it, “By failing to prepare, you are preparing to fail.”

Spend 15-25 minutes on the weekends to plan your meals for the week. This is one of the best grocery shopping tips that is often overlooked.

You will save time and feel less frustrated thinking about what to make after a long day of work. Who’s got time for that?

Once you have your meals planned for the week, you will need to execute it.

Before you drive off to the grocery store, you need to follow this important step.

Make a grocery list and stick to it!

A simple grocery list like this grocery shopping printable will help you steer clear of impulsive spending. It doesn’t matter if that item is on sale or not. Stick to the plan!

With planning ahead, you can cut back on spending by buying the correct ratio of ingredients for your meals and avoid throwing away extra ingredients. Keep the extra money in your pockets!

Creating a meal plan and sticking to it is the best way to save money on groceries.

If you hate meal planning because you can’t decide what to make or simply don’t have the time to plan, then you have to try the $5 Meal Plan.

For just $5 a month, you will get weekly meal plans and grocery lists sent to you. The amazing thing about the program is that the meals they come up with cost less $2-$3 per person!

We save a ton of money each month with the $5 Meal Plan because it allows us to cook healthy meals at home instead of ordering take-out and dining out. This was a no-brainer for us.

You can try it for free for 14 days here and cancel it if you don’t like it. No questions asked.

4. Get cash back on groceries

Savvy shoppers have many techniques up their sleeves to get the best deals on their shopping carts.

One of their favorite ways to save money on food is to get cash back on their groceries with the best cashback apps – you can earn money on your everyday shopping, and not just groceries.

Just check out how many categories they have!

- Snacks & Sweets (e.g. chips, cookies)

- Daily & Eggs (e.g. milk, eggs)

- Deli & Ready Meals (e.g. sausages, deli)

- Meat & Seafood (e.g. chicken, fish)

- Beverages (e.g. smoothies, bottled drinks)

- Beer, Wine & Spirits (variety of alcohols)

- Frozen (e.g. burgers, ice-cream)

- Pantry (e.g. salad dressing, mayonnaise)

- Babies & Kids (e.g. diapers, baby wipes)

- Home (e.g. cleaning products, laundry detergent)

- Personal Care (e.g. soap, shaving cream)

- Medicine & Health (e.g. cough syrup, vitamins)

- Pets (e.g. pet food, litter box)

It’ll be very hard for you to walk out of the store without one of those items in your shopping bags. And here’s a screenshot of my $55.10 check that’s being mailed to me! HORRAY for FREE cash!!!

Speaking of free cash, I also have a separate post that will show you the legitimate ways to get free money today – be sure to go through the list to see how you can get $1,000 to $5,000 in free cash!

5. Don’t go grocery shopping when you’re hungry

When you’re hungry, you think you can eat EVERYTHING in the store. 10 plates of spaghetti and meatballs suddenly seem like appetizers to you.

That’s your stomach talking, not your brain.

Don’t let your hunger take control of your thinking or else you’ll end up buying way more food than you can eat.

According to BBC, when you go food shopping while hungry, you’re just going to buy junk. We will end up making unhealthy choices related to food since we’re more likely to make errors in judgment when hungry and distracted.

Food for thought – think twice before you go grocery shopping on an empty stomach!

6. Buy conventional if you can’t afford organic

For many people who want to eat healthy, organic is often the gold standard. So, many people avoid eating conventional fruits and vegetables because they’re not labeled as organic.

What most people don’t realize, though, is that in their quest to avoid non-organic products, they end up choosing foods that are more harmful—those that are filled with carbs and sugars! While organic produce may seem like the healthiest choice, focusing solely on organic labels can sometimes lead us down the wrong path.

The truth is, that both organic and conventional fruits and vegetables can be part of a healthy diet. Instead of focusing solely on organic labels, we should place more importance on the overall nutritional value of foods. There is actually no clear evidence that organically grown food is more nutritious or safer.

I’ve been a victim of the idea that organic is better, too! I used to buy organic dark chocolate (without looking at the ingredient list or nutritional content) and was later surprised to find out it had a lot of hidden sugar!

Personally, I prefer to buy whole and organic foods, especially when they’re within my budget. But there’s nothing wrong with going for conventional food when you need to stretch your dollars.

So I suggest you stop paying more for food labeled as organic if it’s not feasible for your budget. Keep the extra money instead, so you can add more to your savings. Just remember that what’s important is eating more fruits and vegetables!

7. Buy frozen vegetables

I know what you’re thinking! “But fresh vegetables are healthier than frozen ones!” Well, that’s where you’re mistaken.

Studies have continuously shown that the nutritional value of both fresh and frozen vegetables is the same. In fact, in some situations, frozen vegetables retain nutrients better than fresh vegetables since they’re frozen shortly after being harvested—right at their ripest.

Frozen vegetables have a longer shelf life, so they’re less expensive than fresh vegetables.

Plus, they’re also less likely to go to waste! Can you remember a time when you had to throw away a bag of slimy spinach or a mushy cucumber because you forgot about them in the back of the fridge? With frozen vegetables, that won’t be a problem. You won’t have to worry about wasting money, but most of all, you won’t be contributing to the world’s food waste.

With 30-40% of the food supply in the United States going to waste, every little bit counts!

This is how to save on food costs while eating clean at the same time! Don’t ever think that it’s more expensive to be healthy.

8. Stockpile like a pro and live frugally

Remember the last time you got an amazing deal on pasta sauce and bought 10 jars?

That will last you for years to come, right?

Well, guess what? After a few months, your pantry is out of pasta sauce, and you find yourself back at the store again! But this time around, the sauce is not on sale!

Don’t shy away from stocking up on items that can be stored for a long time when they go on deep discounts. This is one of the most simple and effective ways to live frugally and save money on your groceries.

Use the FIFO (first in, first out) system when cooking to avoid food spoilage.

Here are some items to stockpile in your pantry:

| Item | Storage Life (Unopened) |

| Rice and dried pasta | 2 years |

| Dried beans, lentils, peas | 12 months |

| Dried nuts | 12 months |

| Dried fruits | 6 months |

| Oats | 18 to 24 months |

| Sauces | 12 months |

| Olive or vegetable oil | 6 months |

| Canned meat | 2 to 5 years |

| Canned soup | 2 to 5 years |

| Canned fruits | 12 to 18 months |

| Sugar | 2 years |

| Salt | 5 years |

| Spices | 2 years |

| Flour | 6 to 12 months |

Source: United States Department of Agriculture (USDA)

9. Skip the pre-cut food

When you walk by the fruits and vegetables section, do you wonder why the fruit and veggie platters are so expensive?

Sure, the fruits and vegetables are nicely cut and packaged together, but you can easily make the same trays with the EXACT same fruits and vegetables at half the cost!

Those ready-to-go trays are made and priced for people who are in a hurry and don’t have time to prepare food themselves.

Fruit and veggie platters are great for gatherings and parties, but definitely not for our wallets. Buy whole produce and cut them yourself.

10. Buy frozen fish

I agree that fresh fish tastes better, but frozen fish costs less and is just as good for you. So, next time you go to buy fish, think about getting frozen fish to save money.

Frozen fish are priced much lower than fresh fish because their shelf life is significantly longer, not because they are lower quality.

The FDA recommends we keep fresh fish in the refrigerator for 1-2 days max. But with frozen fish, you can store it in the freezer for 2-3 months (e.g., salmon) or 6-8 months (e.g., cod).

In fact, the quality and nutritional value of frozen fish are just as good as those of fresh fish, according to SINTEF, a Norwegian research company.

With today’s technology, freshly caught fish are frozen on the boat (frozen-at-sea) with flash-freezing units within hours of catch. This process locks in the moisture, flavor, and nutrients of the fish.

Why pay more when frozen fish is just as good as fresh fish?

11. Don’t be fooled by packaging

It’s often difficult to compare prices when different brands of the same product are priced differently. One of their tricks is to package the product in ways that make it look fuller than it is!

Can you tell which bag of frozen broccoli is cheaper?

Brand A) $2.99 for 500g (smaller bag)

Brand B) $5.98 for 907g (bigger bag)

This kind of pricing makes it hard for beginners learning how to save on groceries. Unless you’re a math whiz, pull out your cellphone and crunch the numbers on the calculator to see which one is a better buy.

The cost for Brand A is $0.60/100g while Brand B charges $0.66/100g. In this example, you’ll get more value by choosing Brand A.

Luckily, some stores display the price per unit on the price tag, so shoppers don’t need to do the math themselves.

Beware of packaging tricks and look for the price per gram/ounce/liter to compare the true cost.

12. Store your food properly

Do you know how much food is wasted and thrown away each year?

Hang on tight; you’re going to be blown away by the stats. According to Feeding America, it is estimated that we throw away 30% – 40% of our food.

A family of four tosses out ~$1,500 worth of food a year!

That’s a great deal of food sent to the landfill and a lot of money down the drain!

One of the reasons why so much food is thrown out is because we overbuy groceries and don’t store our food properly.

Rather of keeping the extra raw meats in the refrigerator, freeze the extras to extend their freshness. This will help reduce food waste and save you money at the same time.

Here’s a meat freezer guide provided by the USDA:

| Item | Storage in Months |

| Bacon and Sausage | 1 to 2 |

| Casseroles | 2 to 3 |

| Egg whites or egg substitutes | 12 |

| Frozen Dinners and Entrees | 3 to 4 |

| Gravy, meat or poultry | 2 to 3 |

| Ham, Hotdogs and Lunchmeats | 1 to 2 |

| Meat, uncooked roasts | 4 to 12 |

| Meat, uncooked steaks or chops | 4 to 12 |

| Meat, uncooked ground | 3 to 4 |

| Meat, cooked | 2 to 3 |

| Poultry, uncooked whole | 12 |

| Poultry, uncooked parts | 9 |

| Poultry, uncooked giblets | 3 to 4 |

| Poultry, cooked | 4 |

| Soups and Stews | 2 to 3 |

| Wild game, uncooked | 8 to 12 |

13. Buy seasonal

You can buy and enjoy your delicious watermelon any time of the year. However, if you want SWEET and CHEAP watermelons, buy them when they’re in season.

Fruits and vegetables that are in season are easier for farmers to grow and ship to your local grocers.

Foods that are out of season are grown far away and require high shipping costs. These costs are reflected in your grocery bills.

14. Try store brands

Before you shut down the idea of buying store brands, you should give it a try.

Generic brands are often viewed as cheap knock-offs of popular brands. But not all store-brand products are of lower quality compared to the big names.

There are items where you can’t tell the difference in quality between brand name and store brand, but the savings are significant. For example, Costco’s Kirkland paper towels are cheaper than Bounty paper towels, but in terms of quality, they’re just as good as Bounty.

After you’ve tried the generic brands and simply can’t stand them, stick with brand names.

When you buy generic brands, always compare the prices with brand names. Sometimes, brand names go on sale and will cost less than store brands.

15. Buy discounted gift cards

One way to save money on your groceries is by purchasing discounted gift cards for your beloved local grocery store.

Just think about it: you could save anywhere from a nice little 1% to an amazing 15% just by keeping an eye out for the best deals on discounted gift cards online.

It’s like giving yourself a bonus every time you shop! Who wouldn’t love that, right?

16. Try intermittent fasting

Intermittent fasting isn’t for everyone. I used to think the idea was crazy because I was naive (and quite uneducated) to think it meant starving yourself, but this is far from the truth. Quite the opposite, actually.

It wasn’t until I researched and read more about its health benefits (and did it the right way) that this absolutely changed my life for the better. On top of that, I saved more money on groceries once I started to get used to this lifestyle.

On a high level, what I usually do is skip breakfast and eat at lunch and dinner (only whole and nutritious foods that nourish the body and soul).

I eat my so-called “brunch” around 10:30 to 11:00 am and don’t eat dinner until 5:00 pm. If I’m hungry in between, I may go for a light and healthy snack that isn’t expensive, like carrots and hummus or avocado toast. If I do eat a light snack, I’ll eat dinner around 6:30 pm and be done by 7 pm.

This routine allows me to fast anywhere between 15 to 17 hours because I am done with my dinner by 6:00 pm (or 7:00 pm) and don’t eat until 10:30 to 11:00 am the next morning.

By doing this every day, I no longer crave junk foods or have the urge to eat every 2-3 hours due to emotional pleasures. As a result, it helps me live healthier and save big on groceries.

17. Look above and below the shelves

If you want to be mindful and save money on food, don’t just look at the middle shelves where the eye level is. That’s where supermarkets display more pricey items for you to see.

Chances are, you’ll spend more money on those items compared to the better-valued ones placed above or below the shelves.

According to the National Geographic article, “Surviving the Sneaky Psychology of Supermarkets,” the author writes:

Even shelf order is a psychological trap. The most expensive items are generally placed conveniently at eye level; generic brands are on the lower shelves such that, to get at them, you have to crouch. Foods meant to appeal to kids are set at kids’-eye-level; and one study by researchers at Cornell found that kid-targeted cereal packaging is designed such that cartoon characters on the boxes make eye contact with (short) passers-by.

18. Ditch the big spender

Money ain’t a thang for big spenders.

They have expensive tastes and are the first ones to buy the hottest and latest products.

Don’t get me wrong, big spenders are nice people, but they’re terrible when it comes to money management. Jack, we still love you.

While grocery shopping, they’ll pick the most expensive items from the aisles and justify their decisions by saying that quality things are more expensive.

It’s no surprise that we tend to go over budget when we’re around big spenders. Shopping with someone can be fun, but if you’re trying to stretch your dollar, you might be better off ditching the big spender.

How much do you spend a month on food?

If you don’t know the answer to this question off your head, you’re probably spending a lot more money on food than you realize.

Go ahead, do some quick mental math. You’ll see where you stand compared to others.

According to the U.S. Department of Agriculture (USDA), the average spending on food per month for a household is $7,061 in 2017. This includes eating at home and dining out. And yes, that cost also includes your daily coffee, alcohol, and other beverages!

On average, we spent~5.9% of our income on groceries and ~4.5% eating out. That’s 10.5% of our income spent on food!

A person making $50,000 annually would spend $2,950 a year or $245 per month on groceries.

Your food bill may be higher or lower depending on the type of food you buy at the grocery store. Organic and non-seasonal foods tend to be more expensive.

FAQs About How To Save Money on Groceries Every Month

These are the most asked questions from people around the world regarding how to save money on grocery shopping. I answered them in this section here for you.

1. How to save money on groceries for one person

To save money while grocery shopping for one person, you can follow my suggestions outlined in this article, as well as the following tips:

- Invest in affordable, healthy foods: A high price tag doesn’t always equate to high-quality food. For instance, peanuts, sardines, and potatoes are often labeled as “poor man’s” food. Yet, they are nutritionally dense, packed with essential vitamins and minerals, and are quite affordable. Whether you’re single or living with others, you can save money on groceries by purchasing budget-friendly, healthy options. Some examples include dried beans, bananas, canned fish, peanut butter, potatoes, rice, eggs, oatmeal, apples, and a variety of spices and herbs.

- Meal plan using consistent ingredients: Based on the list of affordable foods, you can save money by creating meal plans that utilize the same ingredients in different ways. For instance, one evening you might enjoy a mixed salad with lentils and canned tuna, and the next day, you could use those same mixed greens and tuna to craft a delicious sandwich. Alternatively, leftover beans can be repurposed into a hearty bean and tomato soup, complemented by herbs and fresh chicken.

- Use your freezer to preserve food: When living alone, you often have the advantage of extra freezer space for storing prepped meals. From fruits and veggies to beef, chicken, and even soups, almost anything can be frozen. This approach not only helps save money but also time, especially considering that cooking for just one person might sometimes feel less rewarding compared to preparing meals for a family.

2. How to only spend $100 a month on groceries?

Spending only $100 a month on groceries can be unrealistic and challenging, even for just one person, not to mention a family of 3, 4, or even 5!

If you’re really aiming to limit your monthly grocery expenditure to $100, you might have to sacrifice quality, variety, and potentially even the nutritional balance of your diet.

This could mean relying heavily on more affordable, but less varied, food sources such as rice, beans, and certain vegetables. Here’s a list of economical foods you could incorporate into a budget of $100 or less per month:

- Beans

- Rice

- Bread

- Pasta

- Eggs

- Frozen fruits

- Frozen vegetables

- Canned goods

If you’re striving to maintain a healthy diet on a tight budget, you may need to invest significant time in activities such as growing your own produce, meal planning, hunting for deals, and preparing meals from scratch. Consider this a full-time job in itself; you may find that it leaves little time for anything else beyond cultivating your food, prepping, and cooking three meals a day.

It’s important to remember that while saving money is crucial, it shouldn’t come at the expense of your health. So, if you’re considering such a tight grocery budget, think about ways you can keep meals balanced and nutritious. Perhaps consider community resources like food banks or discount programs to help supplement your food budget.

Remember, this is a very frugal budget and might not be feasible or healthy for everyone, especially for larger households, those with special dietary needs, or in areas with high food costs.

3. How to only spend $300 a month on groceries?

This is doable if you are following the best frugal living tips which could take up more time in exchange for the cost of saving money.

Spending $300 a month on groceries for a family is also stretching it if I had to be honest. But it is a very healthy and realistic budget for those looking for how to save money grocery shopping for one person.

Keep in mind that this depends on where you live, the size of your household, and your dietary needs and preferences. For example, larger cities tend to charge more for groceries due to higher overhead costs including rent, employee wages, and transportation, as well as the increased demand driven by a denser population.

However, with careful planning, smart shopping, and a bit of flexibility, it may be possible. Here are some strategies that may help you spend only $300 on food each month:

- Grow Your Own: This approach may be the most cost-effective way to reduce spending on groceries, but it does require a significant time investment. My aunt follows this method and seldom shops at grocery stores, except during the winter months. If you have the space and the time, consider growing your own vegetables and herbs. This strategy can help save money while providing you with fresh produce.

- Plan Your Meals: I plan my meals every week, so I know exactly how much I’m spending without thinking about what to eat on a daily basis. Plan your meals for the week, including breakfast, lunch, dinner, and snacks. This will also help you avoid impulse purchases and ensure you only buy what you need.

- Buy in Bulk: I like to buy non-perishable items like grains, legumes, and canned goods like salmon or tuna (occasionally) in bulk to save money. But be cautious not to over-buy perishable items.

- Eat Seasonally: Fruits and vegetables that are in season are usually cheaper. They’re also fresher and tastier.

- Cook at Home: I used to eat out so often due to a demanding job, but meal planning at home has helped significantly. You’ll be surprised to add up the numbers and see that prepared foods or eating out can quickly inflate your budget – you can even check out my post about the 12 stupid things I stopped buying to save money to see how much takeout adds up. Cooking at home is often cheaper and healthier.

- Use Leftovers: Be creative with your leftovers to ensure nothing goes to waste. Make soups, salads, or stir-fries with what’s left. I like to make a quick salad with leftover chicken or fish.

- Avoid Expensive Items: Try to limit or avoid costly items like organic produce, pre-cut fruits/vegetables, and premium meat cuts. Instead, opt for conventional produce, whole fruits/vegetables, and less expensive protein sources like eggs, tofu, or canned fish.

- Shop Less Frequently: The more often you go to the grocery store, the more likely you are to make impulse purchases. Try to limit your shopping trips to once a week, or even less frequently if possible.

Final thoughts on how to save money on groceries

Saving money on groceries and food may seem like a daunting task because you’re so used to buying what you regularly buy without a plan.

When you go grocery shopping this week, be sure to rethink your purchases and follow the tips listed in this post.

Okay, let’s do a quick recap on how you can save money on your next grocery trip:

1. Create a food budget that works.

2. Plan your meals and stick to it. If you’re not good at meal planning, consider trying out this 14-day trial $5 meal plan for free!

3. See a list of free money resources to see how you can get cash back on your groceries.

4. Don’t go grocery shopping when you’re hungry.

5. Buy frozen vegetables for the same nutritional value at more convenience and less cost.

6. Stock up on a reasonable amount of food that has longer shelf-lives while avoiding waste.

7. Rethink whether you really need to spend more on organic foods.

8. Ditch the pre-cut foods.

9. Consider buying frozen fresh for a lower price over fresh fish without having to sacrifice on quality.

10. Don’t be fooled by the marketing strategy of the appearance of “bigger packaged” items.

11. Store your food properly to avoid food waste.

12. Buy seasonal foods because it is cost-effective.

13. Try some in-store brands before judging a book by its cover.

14. Don’t shop with big spenders or shopaholics.

15. Look above and below the shelves because lower-cost alternatives are stored there.

Over to you — how do you save money at the grocery store each week? Do you have tips on how to save money on groceries and food?

#5. I agree that there is probably little taste difference between conventionally grown and organic foods. But the real argument is environmental. Do you really want to eat food that’s been farmed by agribusiness, using pesticides that kill bees along with the crops’ pests, as well as birds that eat such poisoned insects? Or seeds that limit biodiversity? Or fertilizer that runs into the water killing various water species and into our drinking water while sterilizing precious top soil? Or food that has been trucked cross country maximizing carbon emissions? When it comes to organic food, I believe it is worth every penny.

Lots of great tips in here. I wouldn’t have thought about not having big spenders with you while grocery shopping. Aside from them wanting to buy more expensive items, I feel like their presence also psychologically gives you permission to spend more too which isn’t great when you’re trying to stay on budget. Do you have any thoughts on CSA boxes and whether or not they’re worth it?

Hey Kate!

To be honest I haven’t tried CSA but it seems like a great way to support local farmers. This seems more suitable for people who know how and what to cook.

We currently use meal plans which gives us a list of ingredients to buy, so we’ll go out and buy them. This still helps us save time and money especially when we’re not masters of cooking. 🙂

Plus, we like going to the grocery stores hand picking our fruits and veggies.

Thanks for dropping by and leaving a comment!

Great post ling. I love saving money on food. I especially love batch cooking and freezing fruit that i have grown myself. Saves me quite a bit of money every month.

Hey Lee!

I think batch cooking and freezing them is a great way to save money on groceries and food. It’s also a great way to save time! Cooking meals can take up a lot of time depending on what’s being prepared and cooked.

Thank you for your saving money tips on food! 😊

So many great ideas! Since I’m shopping for a family of 6 (including 3 teens and 1 tween – big eaters!) we spend a LOT on groceries. I would only add one more tip, and that is to shop the discount “no frills” stores. There is seriously one high-end grocery store near me that has a live band playing on the weekends. How do they pay for that? By marking up the prices! Go to the bag-it-yourself stores if you can.

And a question for you: do you think that grocery delivery is worth the extra cost? There’s less risk of impulse purchasing because you’re not walking through the aisles of the store, but there is the cost of delivery.

Hey Kari!

That’s another great way to save money on groceries. The no frills or discounted shops provides great value and I find the fruits and veggies are fresh too depending on which discount shop you go to. Almost no difference from the classier grocery stores. I had no idea they had bands playing on the weekends… though it sounds like a cool idea. Haha.

I think grocery delivery is worth it for convenience and saving time. It really depends on the individual and whether they like to go grocery shopping or not. The only downfall for me is I don’t get to pick my own fruits/vegetables and I’d have to just take whatever is delivered to me. 😂

ling, please update your income report for blogger motivation…

We really miss that series…please give some update