We will receive a commission if you make a purchase through our affiliate link at no extra cost to you. Please read our disclosure policy for more information.

Are you looking for a budgeting plan to help tackle your debt and get your finances back on track so you can finally stop stressing over money problems?

That’s great!

But you don’t want to track every single receipt on a spreadsheet or feel bad for enjoying a night out with friends?

Not a problem!

You see, budgets are supposed to HELP you reach your financial goals, not make you feel shameful because you forgot to ask for a receipt from the cashier or the fact that you bought a coffee from Starbucks instead of brewing your own at home!

The key to an effective budget is striking the balance between spending and saving without you feeling like you’re being deprived of life. Learning how to create a budget today will save you from financial troubles years down the road.

Now, this sounds like common sense, but with so many competing priorities, endless bills to pay, and monthly birthday parties to attend, it’s easy to lose track of where your hard-earned money went!

Fortunately, Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, came up with an intuitive and simple budgeting system called the “50/30/20 budget rule” that you can follow and get your money in order while leaving room for you to enjoy the small things in life.

TLDR: The 50/30/20 is a rule of thumb where you assign 50% of your budget to cover your “needs,” 30% for your “wants,” and 20% goes towards your savings or debt repayment.

Before you read on, you can also check out this helpful post that will answer your burning question: Which payment type is best if you are trying to stick to a budget?

Don’t forget to save and pin this blog post here on Pinterest so you can always refer back to this simple budget plan and finally master your money! 🙂

How to Budget Your Money Using the 50/30/20 Rule

The reason why it’s so easy to follow is the fact that you only have 3 broad categories to allocate your take-home pay:

- Needs

- Wants

- Savings or debt repayment

Look how simple and clean this budget already is!

By working with 3 budget categories only, it allows you to focus on the big picture of your finances and avoid the need to track down every dollar of your budget.

You don’t need to get into the nitty-gritty detail and breakdown all your spending into different expense categories like housing, transportation, food, utilities, entertainment, etc. You just need to look at the overall categories and not go over the limits.

Tracking expenses and documenting receipts is HARD WORK. The last thing you want is to pull your hair out trying to figure out where that strange penny went!

That’s where budgets fail. No one wants budgeting to feel like work.

Less is more, my friend.

Now you know how easy this budgeting system is, let’s go over the steps on how you can budget your finances using the 50/30/20 rule.

1. Determine Your Monthly After-Tax Income

As with any budgeting method, the first step is to calculate your AFTER-TAX income (not your gross pay).

Don’t forget to check your payroll deductions.

If you have any payroll deductions on your paycheck, such as contribution to your 401(k), IRA, and retirement savings plan, be sure to count these amounts towards your savings goals (20%).

For Canada, such contributions would include your RRSP, TFSA, and any other accounts.

Pay deductions for health insurance, life insurance, or short-term & long-term disability, go towards your “needs” category.

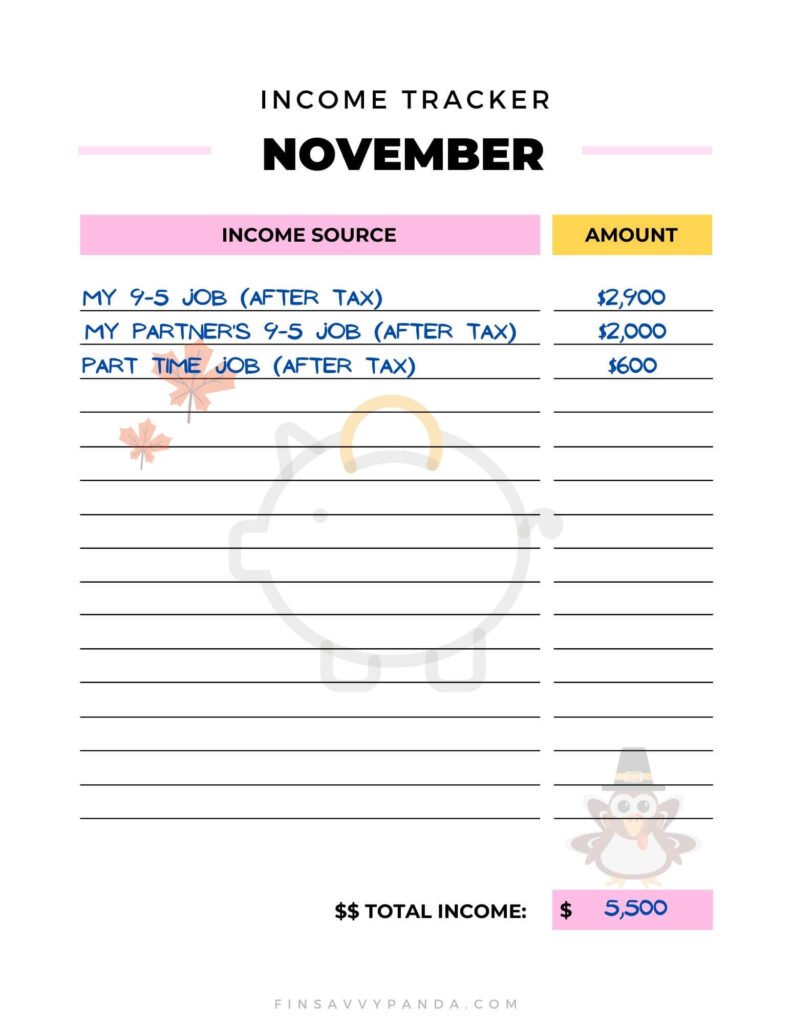

You can also use a convenient and all-in-one budget printable like this one here to track your monthly after-tax income so you can see how much money you have on hand to budget, save and spend.

Here is an example of how the sheet looks for you to organize and write down your sources of income.

Once you know how much money you have to work with, the next step is budgeting!

Throughout this post, we will show you how you can use our instant downloadable printable Power-Up Budget Binder to organize all your family and personal finances in one place! We are very excited for you and can’t wait to see you create and master your budget going forward, so you can finally pay off your debts, earn more, and save more!

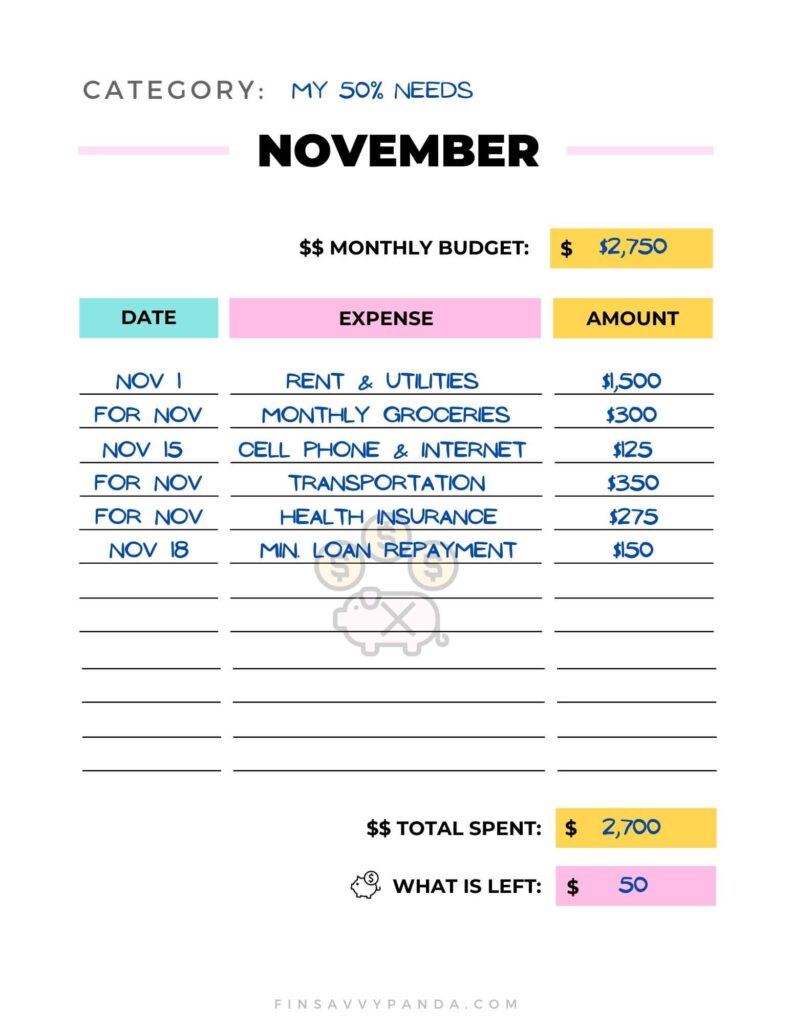

2. Budget 50% for Needs

Based on the 50/30/20 rule, 50% of your monthly income should be used to cover essential expenses that you absolutely need in life to survive and earn an income.

Essential expenses include things like:

- Housing (rent or mortgage)

- Food (weekly groceries)

- Utilities (electricity, water, cellphone, etc.)

- Transportation (monthly car payments, car insurance, transit passes, etc.)

- Health insurance (health, dental, life, etc.)

- Childcare (Daycare)

- Minimum loan repayments (monthly student loan or credit card payments)

Since this category takes up 50% of your monthly budget, it’s very important for you to assess whether something is truly a need or a want.

For example, if you’re shopping for a new car because your current car is giving you problems and you need it to get to work, do you need to buy a top of the line RAV4 or Accord with all the bells and whistles or is this a want?

Are the higher-end finishes required or are they nice-to-haves?

These fancy features can easily cost you an additional $5,000 to $10,000 by the time you drive off the parking lot, so it’s important to understand what you need and what you want.

Again, this downloadable budget binder will help you keep track of your needs each month without feeling stressed or overwhelmed with your spending. It’s so simple to use that my husband and I were able to save our first $100,000 in our 20s when we followed these easy-to-use templates.

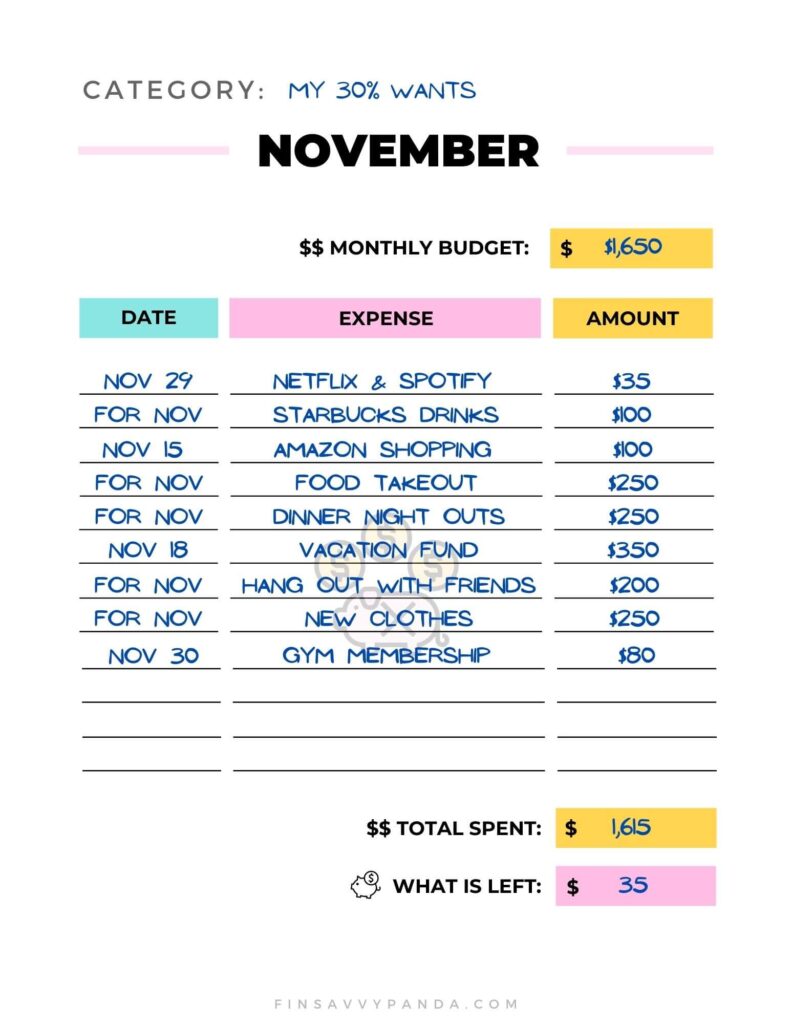

3. Budget 30% for Wants

This part of the budget is where you get to have a little fun!

30% of your monthly income is allocated to “fun money.”

You have the freedom and flexibility to spend your money on anything you want!

Your wants may include things like:

- Daily coffees (Yay! Starbucks!)

- Dining out

- Online shopping

- Monthly subscriptions (gym membership, Netflix, HBO, etc.)

- Vacations!

So, go ahead, enroll yourself in some yoga classes to stay active, catch up with your friends over dinner, or go on a nice getaway vacation because you worked your butt off for it! (If you can stretch your dollar further by knowing how to save money on coffees by getting free Starbucks drinks here, even better!)

Now, while you’re going through your wants list, you may realize that these expenses add up quickly and you can’t afford everything on the list.

This is where you’ll need to make difficult choices and decide which items on the list add value to your life and makes you happy.

The principle to better money management habits is not to hoard all your money, it’s to be intentional with your money.

You shouldn’t feel guilty or bad about spending your money on things you’ve budgeted for it. That’s because it’s part of the plan!

Similar to writing down your needs, you can make this just as easy when you write down your wants using our best-selling printable Power-Up Budget Binder.

You’re more likely to stick to your budget when you have this fun category because we all need to live a little. YOLO!

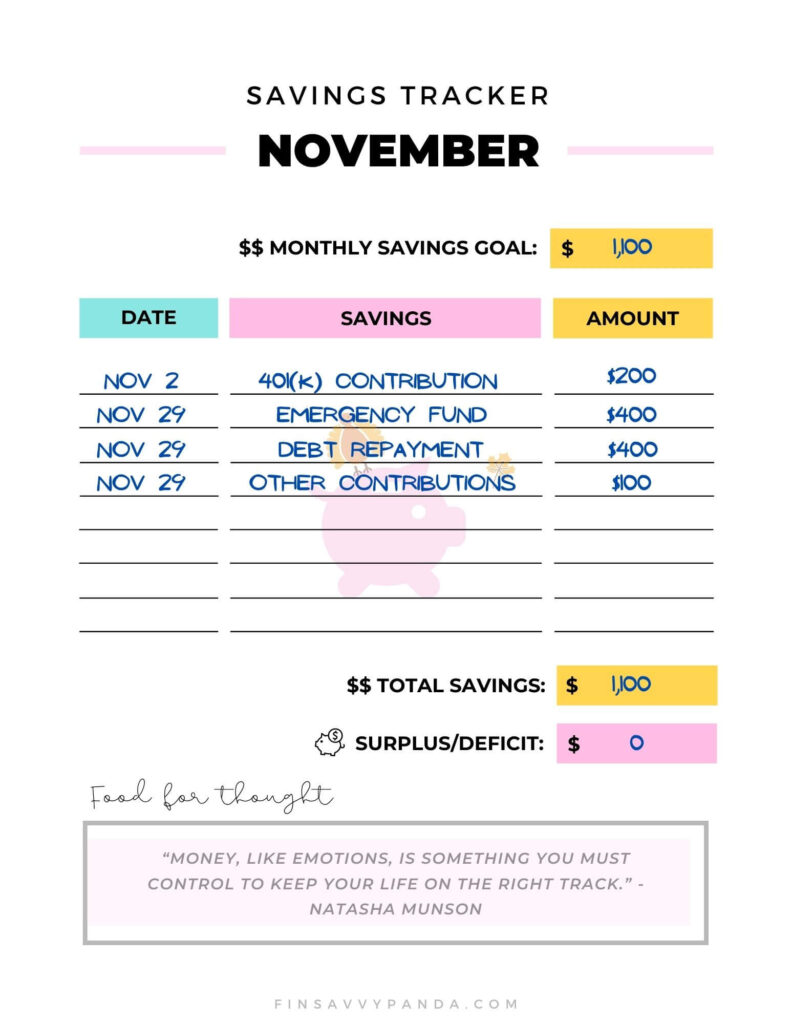

4. Budget 20% for Savings and Debt Repayment

The main reason why you budget is to secure a better financial future for yourself and your family. This is the final piece of the 50/30/20 rule budget that will help you accomplish your goals.

20% of your take-home pay should be dedicated to savings and paying off your debt.

Your savings category could include items, such as:

- Savings plans (emergency fund, down payment on a home, an education fund for your kids, etc.)

- Retirement savings (401(k), IRA, pensions, etc.)

- Debt repayment plan (student loan, car loan, credit card debt)

We also included this monthly savings and debt repayment page in our Power-Up Budget Binder:

You can learn more about our 250+ pages all-in-one Power-Up Budget Binder Bundle here. It includes everything you need to help you get out of debt and build the perfect savings plan that is right for you. It also includes a sheet to write down your personal information and passwords so that you can also refer back to your binder for your family finances.

The binder includes so much more and it’s worth your time learning how this binder can help you come up with a budgeting plan that works for your unique situation.

We know you’ll absolutely love this binder because it just works as long as you follow the plan! It’s literally what we used to save and accumulate our net worth and savings to over $700,000 in 7 years!

And trust us when we say we were once TERRIBLE with money! In fact, we came from low-income minimum-wage families who struggled badly living paycheck to paycheck for MANY years ever since our childhood!

So, we created this beautiful binder so that we can pass on what we learned throughout our years of diligent saving and budgeting. Our goal is to help you ditch debt, build a healthy savings fund, and invest for your future, so you can finally reach financial independence! We really want to see you get out of debt and save your first $10,000, $20,000, $50,000, or even $100,000!

👉 For a limited time, we are offering this all-in-one SUPER valuable Power-Up Budget Binder bundle for 35% – for all that you get, this price is REALLY low and it will help you manage your budget without feeling overwhelmed! As a bonus, it even comes with a FREE mini PDF booklet that will teach you the different budgeting methods, so you can choose the right that fits your personal lifestyle!

Just use the code, POWER35, at the checkout here to snatch this printable binder at an incredible low and affordable price! Hurry and get your copy while it lasts because this offer will expire!

The Importance of Including An Emergency Fund In Your Budget

When it comes to savings, you also need to build an emergency fund to cover unexpected events that you can’t plan for. You never know when you’ll be hit with a huge car repair bill, an expensive visit to the veterinarian, or a job loss.

The recommendation is to have at least 3 months’ worth of essential expenses set aside for emergencies. Trust me, having an emergency fund will give you peace of mind and prevent you from getting into sticky debt situations.

Once you’ve built your emergency fund, it’s important to tackle your high-interest debt (credit card debt) right away. The average interest rate credit card companies charge is very high (16.12% as per creditcard.com) so you need to make it a priority to kill off your credit card debt as soon as possible.

If your employer has a 401(k) match, you should always contribute enough to your 401(k) account to get the maximum match offered by your employer. This is literally free money that you’ll be leaving on the table if you don’t take advantage of it!

Saving money is not easy, but it’s so worth it when you become debt-free and can finally stop living paycheck to paycheck!

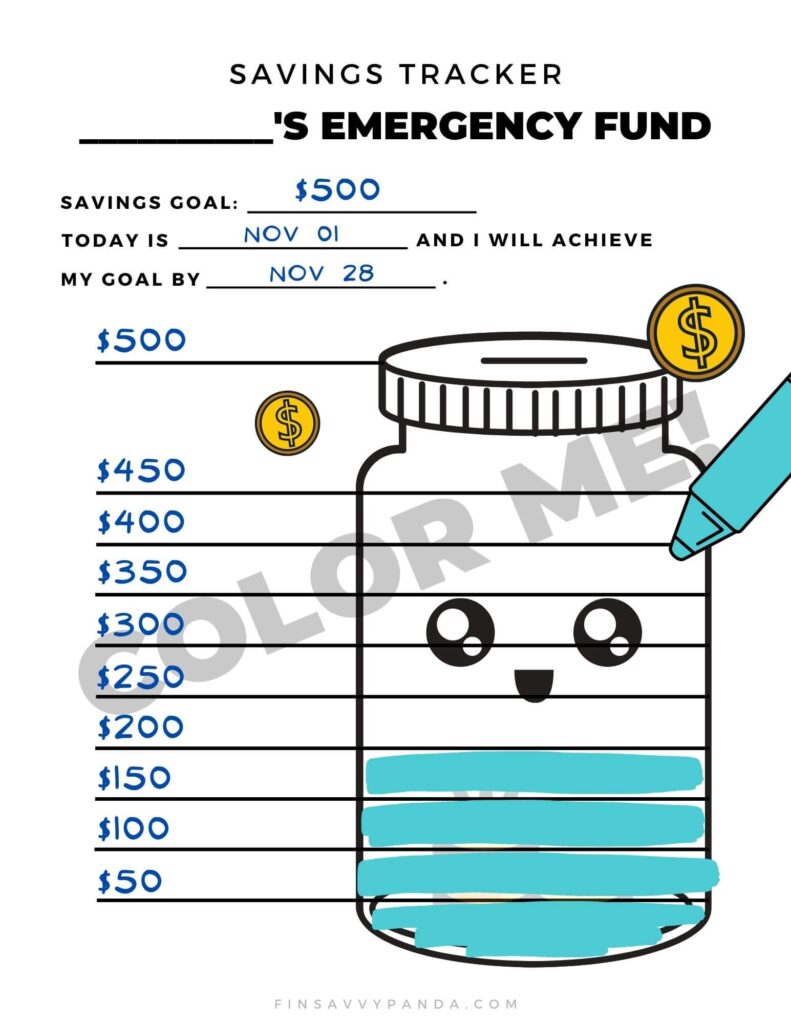

You can start building an emergency fund like this by using a fun color-me-in savings tracker to achieve your goals!

Emergency Fund Savings Tracker found in our 250+ pages Power-Up Budget Binder

Is the 50/30/20 Rule Good for You?

The 50/30/20 rule budget can be a great rule of thumb to follow when you’re new to budgeting.

This type of budget is ideal for you if you like prefer flexibility over structure. It’s easy to understand and use without the detailed expense tracking work.

More importantly, it teaches you the significance of maintaining a balanced lifestyle while you work towards your financial goals.

As with any rule of thumb, it serves as a baseline to make things simple for you. You can tweak the 50/30/20 rule to meet your specific needs.

For example, when you first start, you may need a couple of months to adjust your spending habits, so your budget may look something like 50/40/10.

As you get the hang of budgeting, your budget may shift to 50/35/15. And if you’re want to be more aggressive with paying down your debt or building your savings, you may adopt a 50/20/30 budget.

Does the 50/30/20 rule include 401k?

As I mentioned in this article, the 50/30/20 budgeting rule, a guideline for allocating income, categorizes expenses into three parts: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

So, yes, it does include 401(k)! Contributions to a 401(k) would fall under the 20% savings category.

This rule underscores the importance of regular savings and investment for long-term financial security. When you consistently sock away a portion of your income toward retirement accounts like a 401(k), you can progressively build wealth and prepare for future financial needs.

What I like about the 50/30/20 rule is its adaptability, which gives adjustments to meet my financial goals and obligations, including specific allocations for retirement savings.

Final Words on the 50/30/20 Rule Budget

Whether you’re looking to get out of debt, stop living paycheck to paycheck, or start saving for your first home, creating a budget that fits your personality makes a world of a difference to reaching your financial goals.

By following the 50/30/20 rule budget, you simply allocate your take-home pay to 3 broad budget categories – 50% to needs, 30% to wants, and 20% to savings & debt repayment.

Even when you implement this simple method of budgeting, you’re already way ahead of many people that don’t even have a budget!

Sometimes, no matter how hard you try to budget, there’s just not enough money to work with. In these circumstances, you’ll need to be creative and find ways to make extra money.

Personally, I flipped furniture and started my blog as hobbies to earn extra money outside my full-time job. Today, I’m earning a full-time income by blogging from home. (Yes, I quit my daytime job to blog!) Earning extra money allowed me to increase my budget so I could save more and spend more on things that I love and are valuable to me.

I hope you found this article helpful and it answers your questions on how the 50/30/20 rule budget works!

Which budgeting method do you personally use to manage your daily finance? Let me know in the comments below!

Hello Ling, I live in Cambodia but I am a poor person. Can you help me?